Generative AI in Insurance: How Insurers Can Leverage its Power?

Given that 70% of digital transformation projects fail these days, the onslaught may cause technological hype fatigue. Indeed, 43% of insurance companies currently use AI, with Gen AI ranking first for many. Additionally, Gen AI in insurance can power complex chatbots, automate activities, and analyze unstructured data.

Struggling with Claims Efficiency? Our Generative AI Software Development Services Solves It with Seamless Automation and Insights

“The insurance industry, along with many other sectors, is currently experiencing a sea change. Gen AI is not just an improvement on traditional machine-learning models used for natural language processing or computer vision, for example. It democratizes access to AI, simplifying the interface so profoundly that anyone, regardless of programming expertise, can leverage AI’s power.”– BCG

Detailed Overview Generative AI in Insurance

Generative AI is the branch of artificial intelligence technology that allows machines to develop novel ideas, data, or information that is comparable to what is created by humans. In contrast to conventional AI systems, which depend on preset rules and patterns, generative AI uses complex algorithms and deep learning models to produce unique and dynamic results. It plays a key role in redefining several areas in the insurance sector, including fraud detection, risk assessment, and client interactions.

- Generative AI in insurance sector presents a new paradigm with unmatched potential for innovation and expansion.

- It helps with predictive modeling, which makes it possible to create risk scenarios that give insurers the ability to create proactive risk management strategies.

- Furthermore, by producing customized content, generative AI helps insurers to provide specialized insurance plans and experiences, strengthening client connections.

Opportunities Enabled by Generative AI

Generative AI is now being used in “horizontal” use cases by many enterprise organizations, allowing for the creation of marketing and sales content, automated code generation, virtual assistant dialogue production, and much more. Because of this cross-industry convergence, companies can improve their speed to market and/or become fast followers by utilizing skills developed by others.

Conversely, the insurance industry offers special, sector-specific, and extremely sustainable value-creation opportunities, referred to as “vertical” use cases. These prospects necessitate in-depth subject knowledge, contextual awareness, proficiency, and the possible requirement to improve current models or make investments in creating custom models. The ability to integrate several generative AI use cases to create a comprehensive, seamless, end-to-end solution at scale will be a truly significant change for the insurance sector.

Key Benefits of Generative AI in the Insurance Sector

- It makes enterprise data more valuable. Generative AI can provide the latest ideas by examining enormous amounts of unstructured customer data from marketing, underwriting, claims, and control activities. Gen AI, for instance, might be used to create consumer segments and compare products to create new, highly customized products and enhance customer interaction.

- It expedites tasks and procedures. Underwriters can expedite quote production and claims processing by conserving time by automating repetitive operations, such as document and email classification and manual data input, and by leveraging AI-generated insights.

- It finds hazards and inefficiencies that are difficult to spot. Generative AI can recognize patterns and abnormalities in data, making it an effective tool for risk assessment and fraud detection. With its help, insurers can minimize financial loss by preventing fraudulent claims, improving underwriting decisions, and reducing claims leakage.

- It provides prompt, individualized customer service. By automating repetitive service tasks and giving agents data-driven insights to better address consumer concerns, generative AI optimizes customer service center operations.

Overcome Insurance Challenges with Our Tailored Generative AI Development Services—Unlock Smarter, Faster Decision-Making Today

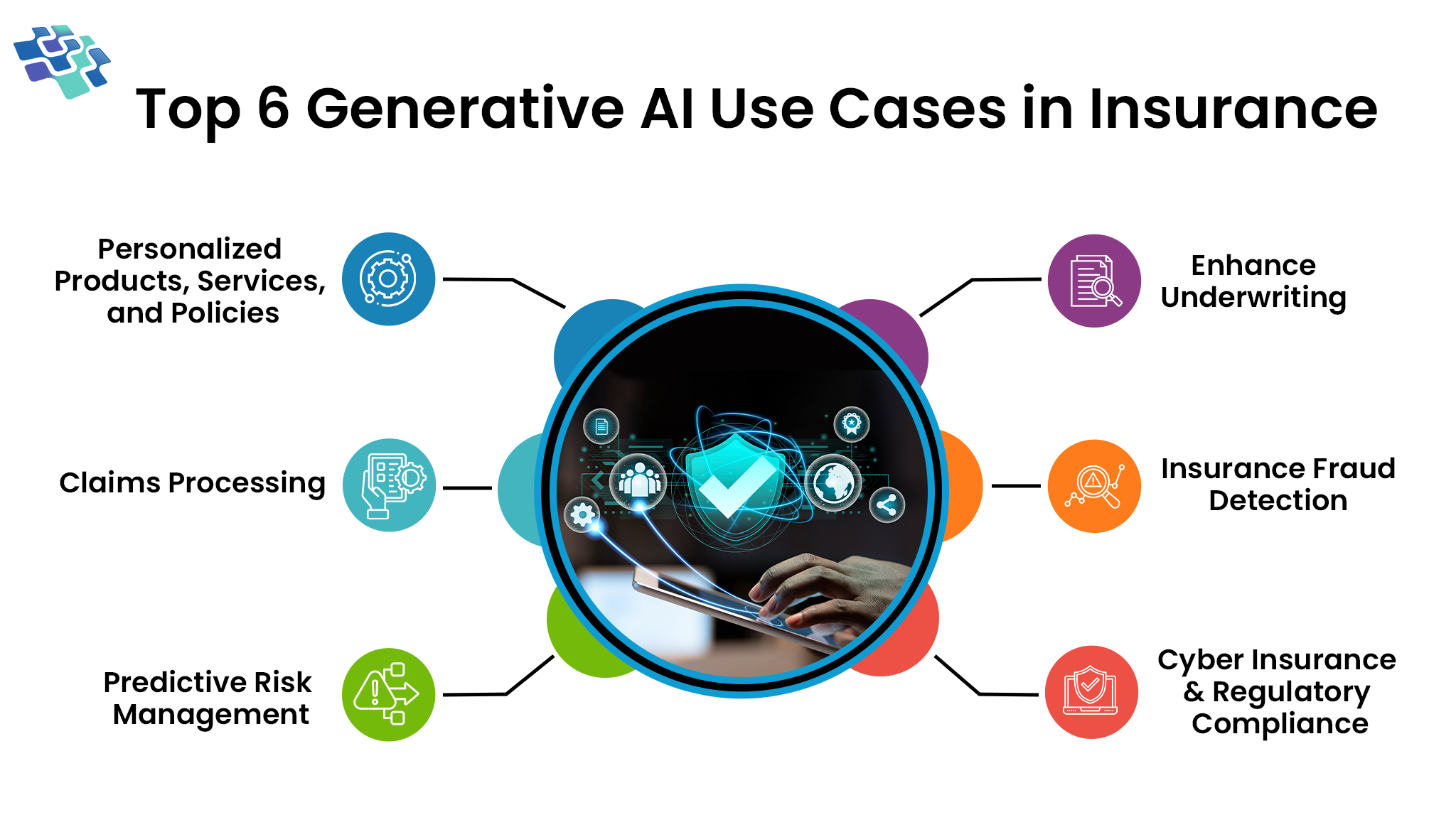

Top 6 Use Cases Generative AI in Insurance

The US insurance market is undergoing a rapid transformation because of generative AI, which has numerous applications that improve operations, customer experience, and efficiency. The top 5 applications of Gen AI in insurance are listed below:

1. Personalized Products, Services, and Policies

1. Personalized Products, Services, and Policies

Currently, generative AI is automating jobs that were previously completed by humans and personalizing customer interactions. For example, insurance firms use conversational AI to respond to consumer questions regarding coverage alternatives and policy details, which lowers the need for live support people and increases cost-effectiveness.

Generative AI expedites decision-making and improves customer satisfaction by quickly recommending customized insurance plans based on consumer preferences and claims history. AI also ensures timely service delivery and improves the entire customer experience by automating the creation of policy papers and offering real-time support through virtual assistants.

2. Enhance Underwriting

Additionally, generative AI can improve the underwriting procedure. To finalize policy terms and decide whether to underwrite an insurance policy at all, underwriters usually must go through a ton of documentation. Generative AI in financial services, for instance, can be trained on risk profiles and customer applications before using that data to create customized insurance plans.

Moreover, you may have Generative AI customize coverage and pricing suggestions by training it on past documents and seeing patterns and trends. The underwriting procedure will be more comprehensive, and the total cost of claims will be reduced. Also, by processing applications more quickly and accurately, underwriters can operate more efficiently, which may result in greater customer satisfaction scores.

3. Claims Processing

Generative AI has a lot to offer in terms of expediting the processing of insurance claims, preventing claims, and automating repetitive processes like data entry and analysis. Generative AI improves efficiency for various claim types in the following ways:

-

- Automated Data Entry: Generative AI inputs data from accident reports and repair estimates, reducing errors and saving time.

- Fraud Detection: Gen AI analyzes historical weather data and property records to spot patterns suggesting fraud.

- Optimized Workflow: AI sorts claims by complexity and resource requirements, improving efficiency.

- Priority Organization: Claims are sorted by severity and urgency, ensuring prompt attention to critical cases.

- Enhanced Data Analysis: Generative AI processes large claims datasets, identifying trends and outliers to predict future claims and prevent fraud.

4. Insurance Fraud Detection

A significant industry is insurance fraud. The FBI estimates that $40 billion is lost yearly because of insurance fraud, which costs the typical family between $400 and $700. Although not all insurance fraud can be prevented, insurance firms usually include it in rates to mitigate the cost. Promising strategies to decrease insurance fraud are provided by generative AI.

Generative AI can identify abnormalities or actions that differ from the norm by examining patterns in claims data. Generative AI can flag claims for additional examination by qualified personnel if they do not fit the anticipated patterns. This helps preserve the integrity of the claims process and ensures the veracity of claims.

5. Predictive Risk Management

Predictive analytics is used by generative AI to evaluate new risks and dangers to the insurance sector. Insurers can predict risks such as severe weather, economic downturns, or technological disruptions by examining past data and market trends.

AI can, for instance, forecast a region’s susceptibility to floods and assist insurers in getting ready for future flood-related claims.

6. Cyber Insurance & Regulatory Compliance

Enhancing risk management tactics, especially in cybersecurity and insurance regulatory compliance, is made possible by generative AI models. Insurers may better comprehend and evaluate complicated risks by using these models, which mimic cyber threats. Generative AI ensures coverage meets cybersecurity challenges by customizing cybersecurity insurance policies to each client’s needs.

AI reduces human effort and ensures accuracy in regulatory compliance by automating checks and updating policies to comply with changing requirements. This proactive strategy promotes an efficient and flexible culture by helping insurers stay in compliance and quickly adjust to changes in the regulation.

Facing Data Overload? Our Generative AI Services Optimize Claims Analysis and Fraud Detection Effortlessly!

Addressing Challenges & Risks

This section will examine common challenges and offer solutions, emphasizing the need for smooth integration with current systems and issues related to data quantity and quality.

- Data Augmentation: To improve quantity and diversity, augment your current data with information from outside sources, such as publicly available data sets. This can enhance the generalization of the AI model.

- API-Driven Integration: To enable AI systems to interact with older systems, choose API-driven integration strategies. Real-time decision-making and data interchange are made possible by APIs.

- Data Cleansing: Use data cleansing procedures to find and fix mistakes, discrepancies, and anomalies. Maintaining data quality requires regular data cleansing procedures.

- Legacy Systems: It’s possible that legacy systems don’t have the interfaces needed to integrate AI technologies. Inefficiencies and fragmented procedures may result from this.

- Data Imputation: To estimate values based on available data, consider imputation techniques for missing data points. Imputation should be used carefully, though, as improper application could cause prejudice.

Generative AI in Insurance: What its Future Holds

Although there are certain difficulties with Gen AI, many insurers think that the benefits of this technology can spur economic expansion. Additionally, insurers can democratize services by viewing generative AI as a digital extension. The following are some potential future applications of Gen AI in insurance:

- Blockchain for Transparency: Integrating blockchain technology with Gen AI can improve security and transparency in insurance contracts and claims handling.

- Cybersecurity Insurance: As cybersecurity becomes more important, Gen AI could be helpful in identifying and reducing cyber threats and delivering safe services.

- Climate Risk Assessment: Gen AI solutions can be used to evaluate and model climate-related risks considering growing worries about climate change. This aids insurers in anticipating and lessening the effects of environmental shifts.

The trends are endless! It’s crucial to remember that while generative AI has many potential applications, there are drawbacks as well that insurers must carefully consider.

How is NextGen Invent’s Gen AI Solutions Transforming the Insurance Value Chain?

In the insurance sector, generative AI is establishing new benchmarks by facilitating accuracy and customization throughout the value chain. Gen AI helps insurers increase productivity, boost customer happiness, and better manage risks by developing targeted marketing campaigns, customizing insurance policies, and automating claims processing. Addressing issues and moral dilemmas like algorithmic bias and data privacy is essential to maximizing the advantages of Gen AI technology. To effectively manage the risks, it is imperative to work with the appropriate IT services partner.

NextGen Invent is the perfect partner to handle the challenges of Gen AI in the insurance industry because of our dedication to innovation and sector-specific solutions. Our generative AI development services in New York ensure that your business can fully utilize AI while successfully managing hazards and attaining notable operational enhancements.

Designed to easily integrate into every stage of the insurance value chain, NextGen Invent’s Gen AI solutions give insurers the resources they need to fully utilize generative AI. Every facet of your business will profit from more accuracy, lower expenses, and better client experiences thanks to our specially designed strategy for the insurance sector. Insurance firms may improve client satisfaction, remain ahead of the market, and revolutionize their operations by implementing our sophisticated Gen AI capabilities.

Frequently Asked Questions About Generative AI in Insurance

Related Blogs

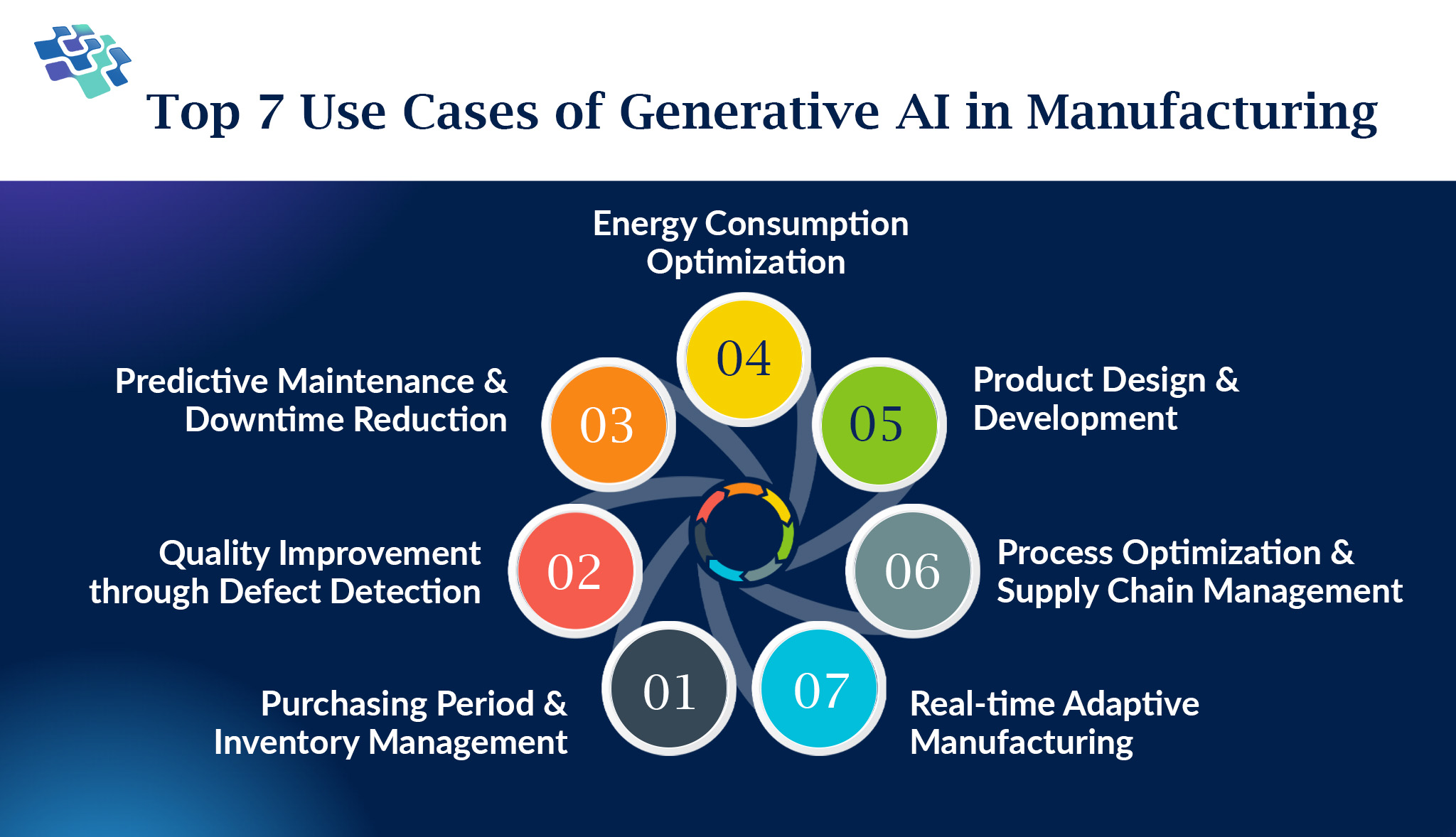

7 Important Use Cases of Generative AI in Manufacturing

The advantages of generative AI for manufacturing businesses, like improved product design, lower expenses, higher worker productivity, and more, facilitate this expansion.

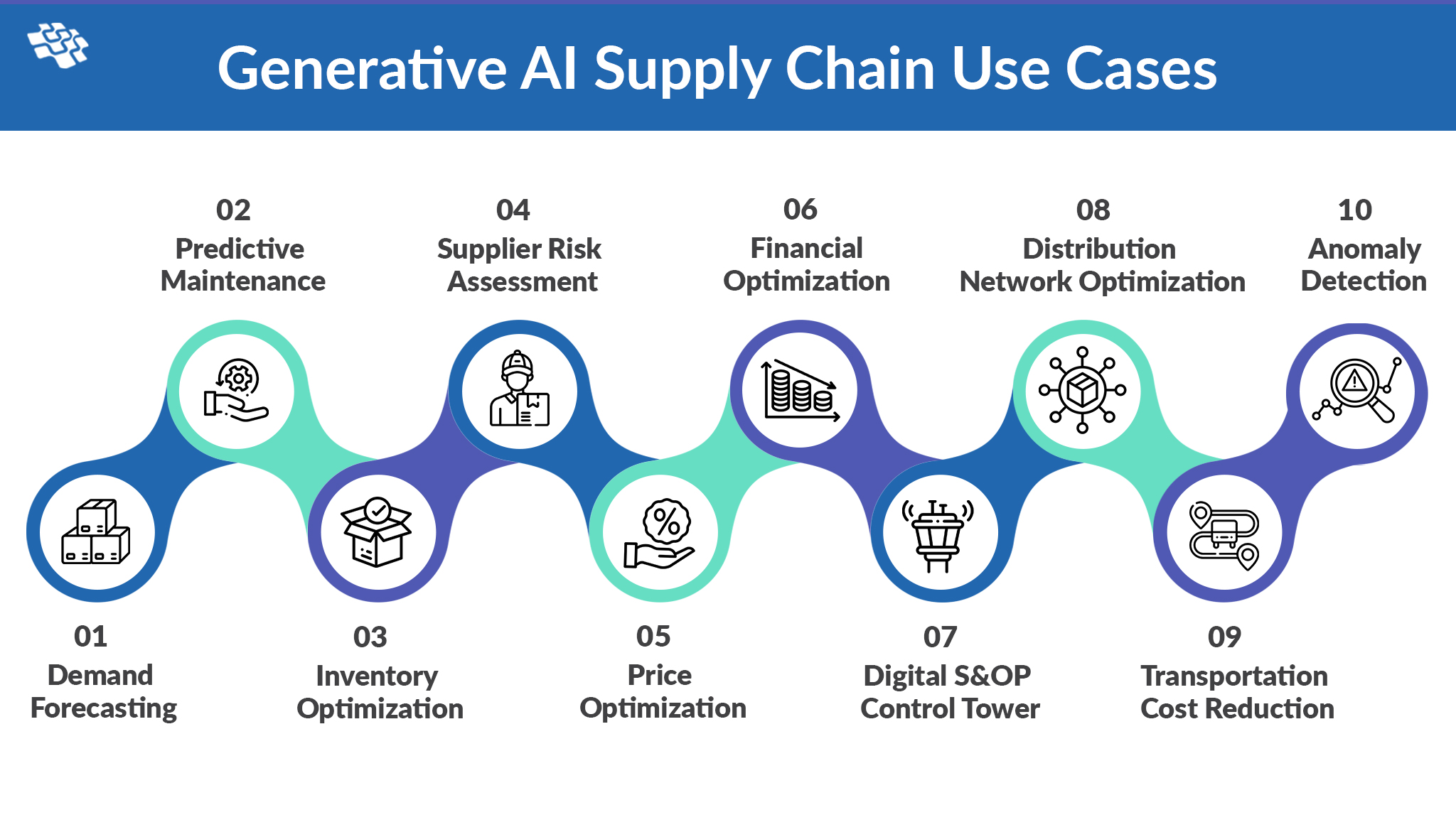

10 Most Crucial Use Cases of Generative AI in Supply Chain

AI integration has changed various industries recently, and the supply chain industry is no exception. The development of Generative AI has shown itself to be a revolutionary way to improve supply chain management.

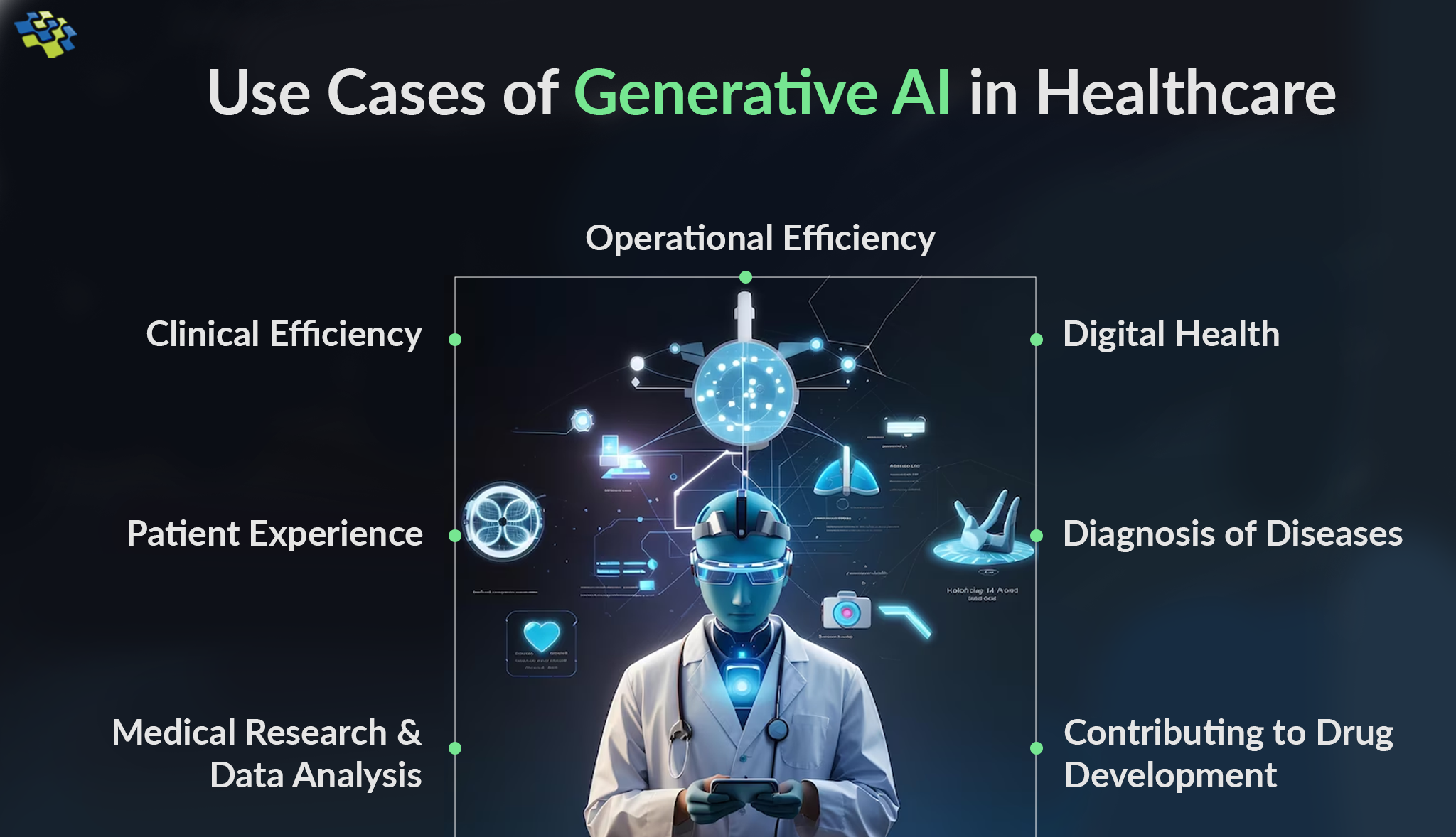

7 Most Crucial Use Cases of Generative AI in Healthcare

Generative AI in healthcare is taking the medical world by storm, offering groundbreaking solutions left and right. Picture this: by 2032, the global Generative AI market is set to hit a whopping $118.06 billion!

Stay In the Know

Get Latest updates and industry insights every month.

1. Personalized Products, Services, and Policies

1. Personalized Products, Services, and Policies