How AI-Driven Data Warehousing in Finance Will Empower FinTech Businesses in 2026

To extract meaningful insights from financial transactions over time, machine learning algorithms require data in a clean, accessible format. This makes the choice of data storage critical. It must be secure, affordable, and scalable, especially when supported by robust artificial intelligence software development services.

Remove Reporting Inaccuracies with A Centralized Financial Data Store Designed For 99% Clean, Validated Records

“Financial services are increasingly required to handle vast, complex datasets while complying with dynamic regulatory landscapes. Traditional data management frameworks struggle to cope with the rapid growth and complexity of financial data. AI, integrated with modern data warehousing solutions, provides transformative potential for addressing these challenges by automating data governance processes, improving compliance tracking, and enhancing decision-making accuracy.”– Research Gate

What Is a Financial Data Warehouse? A Comprehensive Overview

Financial data warehousing is a customized database designed to store and arrange financial information from numerous sources within a business. It acts as a central repository for all financial data, allowing businesses to create reports, carry out intricate analyses, and obtain insightful knowledge about their financial operations.

Finance data warehousing is designed for analytical processing and reporting, in contrast to traditional databases. They make it simpler for businesses to monitor trends, predict future performance, and make data-driven choices since they are designed to manage massive volumes of both historical and current financial data.

Key Components That Power Data Warehousing in Finance

Let’s dissect the fundamental components of finance data warehouses to better understand how they operate:

- ETL (Extract, Transform, Load) Processes: ETL is the backbone of data warehousing in finance. It’s the simple three-step process that keeps everything running: you extract data from different source systems, transform it so it fits the warehouse structure, and then load it into the warehouse. This workflow ensures clean, consistent data that everyone can trust.

- Data Modeling for Finance: Specialized data models designed for financial reporting and analysis are used in financial data warehouses. These models classify data into facts (like sales figures or profit margins) and dimensions (like time, product, or customer).

- Data Sources & Integration: Financial data warehouses bring information together from many different places. They pull data from accounting systems, ERP platforms, CRM tools, daily transaction systems, and even external market feeds. By collecting everything in one spot, teams get a complete and consistent view of the business.

Why FinTech CFOs Need Strong Data Warehousing in Finance to Drive Growth

FinTech businesses operate quickly. However, the need to scale up without showing cracks, make judgments in real time, maintain compliance, and stay one step ahead of the never-slowing competition that comes with that pace.

Data warehousing in finance is justified in this situation. It provides FinTech CFOs with structure, speed, and data trust, things they frequently lack.

- Unified View Across All Systems: A typical FinTech has connections to numerous banks, payment networks, KYC tools, and APIs. Each contains a portion of the narrative, but not the entirety. It’s challenging to recognize trends or identify issues early on without a single point. By bringing disparate data together, a financial data warehouse creates a single, trustworthy image of consumers, risk, and operations.

- Fast, Seamless, Always-On Compliance: Compliance is necessary in the financial industry. Accurate, traceable data is required by GDPR, PCI DSS, AML, and KYC. Every data-driven decision is made quickly and accurately because of an efficient financial data warehouse design that links performance, scalability, governance, and cost control.

- Powering AI-Driven Finance and Future Innovation: AI in banking requires high-quality data. A clean, well-organized FDW becomes FinTechs’ greatest asset as they develop fraud-detection or predictive lending models.

- Reliable, Insight-Driven Financial Forecasting: Good data is essential for making wise judgments. Forecasting revenue, liquidity, or default rates becomes quicker and more precise when everything is organized in one location. Finally, the narrative presented by the dashboards is credible.

See What a Venture Capital and Growth Equity Associate Has to Say About NextGen Invent: Smooth Sailing – NextGen Invent’s Role in Due Diligence Process

Real-World Use Cases of Data Warehousing in Finance

Some of the uses of data warehouses in the financial services sector are listed below:

- Pattern Discovery: To gain accurate insights, financial services organizations must continuously analyze key success and failure indicators. For instance, a bank needs to track customer deposits, loans, reserves, and more to determine how it performs. Also, companies must consider patterns over time, and a data warehouse provides access to historical and current data in one location. Accurate data analysis aids in fraud detection as well.

- Customer Data Management: Financial organizations must evaluate consumer data to enhance the quality of their services and establish enduring relationships with their clients. By gathering information from various sources and enabling pertinent analytics, data warehousing in finance assists them in comprehending consumer behavior and creating a profile.

- Minimize Risks: While keeping an eye on potential risks from various entities, such as competitors and investors, a data warehouse assists in automating the risk management process. Additionally, it protects data by limiting employees’ role-based access and not disclosing all information.

Common Challenges in Data Warehousing in Finance and How to Solve Them

Challenges:

- Data Integration Complexity: It can be difficult and time-consuming to manage data integration from several sources.

- Data Quality Issues: There are difficulties in ensuring data completeness, correctness, and consistency.

- Scalability Constraints: Careful planning is needed to scale the data warehouse to meet high data volumes and user requests.

- Real-time Data Processing: Technical difficulties arise when integrating real-time data inputs and processing.

Considerations:

- Automated ETL Tools: To expedite data integration and minimize manual labor, make use of automated Extract, Transform, Load (ETL) technologies.

- Data Governance Framework: To enforce data quality standards, rules, and processes, put in place a data governance framework.

- Stream Processing: Use stream processing technology to consume and analyze data in real time.

Eliminate Data Latency Issues by Deploying a High-Throughput Finance Warehouse That Supports Real-Time Analytics

How Data Warehousing in Finance Delivers Transformative Benefits for Financial Services

In the finance sector, having the correct information at the right moment can be the difference between profitable and unprofitable investments, as well as between satisfied and disgruntled customers. Stakeholders can monitor KPIs, analyze trends, and make well-informed decisions because of these visualizations, which offer a comprehensive perspective of pertinent economic data.

A financial data warehouse’s significance stems from its capacity to compile and combine data from several sources, ensuring data correctness, consistency, and accessibility.

1. Stronger, Faster, and More Accurate Data-Driven Decision-Making

1. Stronger, Faster, and More Accurate Data-Driven Decision-Making

When your data lives in one place, everything starts to make sense. A study shows that over 80% of RIAs already use data to make better portfolio decisions, and they’re seeing the difference.

- Sharpen asset allocations

- Guide smart strategic shifts

- Track the actions that grow revenue

- Reach clients at the right moments

With data warehousing in finance, RIAs can use unified data to understand client interactions, measure outcomes, and reward teams based on real impact. With centralized data, you gain the visibility to serve clients better, manage finances with confidence, and spend more time on work that grows your firm.

2. Higher Data Consistency Through Seamless, Unified Integration

Several data sources and formats in the financial industry make data integration extremely difficult. Data for financial organizations is frequently dispersed among several sources, such as market data providers, transactional databases, CRM platforms, core banking systems, and more. There are numerous benefits to data integration and consistency provided by a data warehouse.

- First, accurate data analysis and reporting are made possible by financial institutions’ access to a comprehensive and consistent picture of their data.

- Second, a more effective risk management procedure is made possible by consistent and trustworthy data.

Data cleansing, deduplication, data format conversions, and other essential operations to ensure data consistency and integrity can be handled by ETL processes. To further improve the integration process, data warehouse solutions frequently offer features and tools for data mapping, quality control, and lineage tracking.

3. Greater Accessibility and Real-Time Visibility

Financial organizations deal with enormous volumes of data that are dispersed across numerous sources, making it challenging for staff members to find and extract the information they need. The procedure is made more difficult by siloed data, intricate financial data architecture, and inconsistent data formats. A data warehouse organizes, cleans, and transforms data from various sources into a cohesive and uniform structure.

To improve data access, data warehouses frequently use data modeling strategies like star schemas and dimensional modeling. These models make data retrieval easier by allowing users to access and query data in a natural and user-friendly manner. Comprehensive analysis is made possible by offering a consolidated and consistent view of the data, which makes it easy to find trends and useful insights.

4. Centralized, High-Quality Data That Powers Advanced Reporting and Analytics

Insurance companies today are complex businesses with many branches and subsidiaries that produce and receive vast amounts of data (customer information, policies and claims, market circumstances, and more) in various formats from many data sources and internal systems. They prevent data silos and obtain a single source of truth for all departments by integrating data and storing it in one place.

Advanced analysis and reporting tools in a strong data warehouse help teams spot trends, understand operations, and identify customer behavior patterns. They also make it easy to uncover new opportunities and present insights through clear, accurate, and visually engaging reports.

5. Streamlined Data Management with Full Historical Context Preserved

Data warehouses enable businesses to collect and examine consumer data to enhance customer relations and service delivery. Financial companies can employ data warehouses to record every customer encounter, enabling them to check the factors influencing consumer behavior and purchasing decisions. This is made easier by data warehousing in finance, which enables you to swiftly record and monitor vast amounts of customer and historical data from numerous sources.

Data is subject to modification. Because of this, it is essential to have a history of certain data points, which data warehousing makes possible. If the source transaction systems do not maintain data histories, stored information from a data warehouse is also essential.

End Manual Reconciliation Delays Using Automated ETL Pipelines That Standardize, Match, And Verify Transactions Instantly

Essential Data Warehousing Best Practices for Modern Finance Teams

Data warehousing in finance isn’t a plug-and-play solution. It demands clear goals, thoughtful design, and disciplined execution to deliver real value. Success depends on aligning technology with business needs, maintaining data quality, and preparing for ongoing operational challenges.

- Align the warehouse with clear business goals and strategic priorities.

- Identify the most relevant internal and external data sources.

- Use a consistent, analysis-friendly data model for the destination schema.

- Build a scalable architecture supported by a robust ETL process.

- Ensure data quality, governance, and user adoption throughout the lifecycle.

How AI Is Transforming FinTech Operations and Innovation

According to 67% of fintech businesses, artificial intelligence will have the biggest impact on the industry during the next ten years. By 2034, it is anticipated that the fintech industry will have more than quadrupled. AI increases customer experience with more effective and user-friendly services, turns data points into corporate value, and automates tasks that were previously impossible.

AI-driven automation can provide all these benefits, making it a wise investment for companies aiming for productivity and expansion. Let’s look at the AI in fintech use cases that are most frequently mentioned:

- NLP-Enabled Agents: The ability of AI to process unstructured data, including text and voice interactions, documents, and forms, is one of NLP’s most significant developments. Digital assistants and agents driven by AI relieve the strain on your call center and customer service staff. By speeding up response times, enhancing cross-selling capabilities, and relieving human agents of complicated problems, these systems enhance user experience.

- Data Analytics Made Convenient: AI plays a crucial role in the finance sector by detecting shifts in data patterns, evaluating them on its own, and making any required adjustments. AI can offer priceless insights, allowing more accurate forecasting and improved data-driven decision-making even with subpar data quality.

- Document Processing & Automation: Artificial intelligence plays a significant part in fintech RPA, including data extraction, interpretation, and categorization from all related sources. The system communicates insights in clear language while identifying important data points, verifying information against predetermined criteria, checking document completeness, and identifying anomalies or compliance issues.

How Can NextGen Invent Data Warehouse Development Services Help the Finance Sector?

Data warehousing in finance has become a cornerstone for financial institutions seeking sharper insights, stronger compliance, and better customer experiences. When implemented with the right strategy, a financial data warehouse provides a single, trusted source of truth that fuels analytics, automation, and data-driven decisions across the organization. Yet achieving this level of impact requires thoughtful planning, strong data governance, and scalable architecture to ensure long-term success.

NextGen Invent supports this transformation with end-to-end finance data warehouse development services designed for high-volume, high-security environments. We help businesses build scalable, compliant, real-time data foundations that strengthen decision-making and operational efficiency. Along with this, our computer vision software development services add another layer of intelligence, automating document processing, extracting insights from financial statements, detecting anomalies in transactions, and enhancing KYC/AML verification with advanced image and video analytics.

Frequently Asked Questions About Data Warehousing in Finance

Related Blogs

How Generative AI in Finance is Solving Cash Flow and Valuation Challenges?

The way that business and finance are currently conducted could be revolutionized by generative AI. Time and financial commitment up front, along with CFO leadership, will be necessary for implementation.

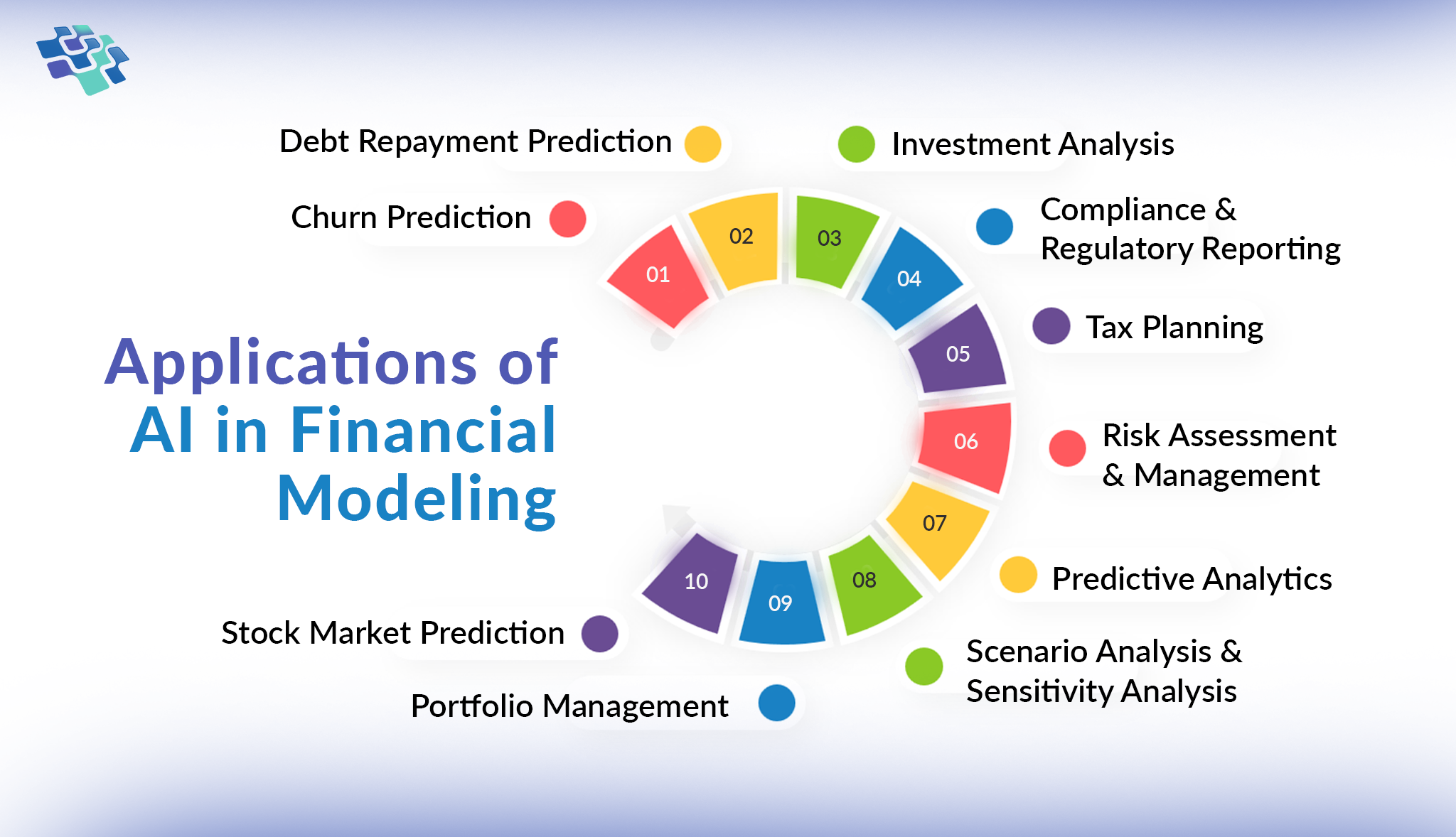

Top 10 Applications of AI in Financial Modeling & Forecasting

Research shows that 20% or fewer errors were made overall in 50% of organizations that used AI for forecasting. Furthermore, a minimum 50% decline was observed by 25% of the enterprises.

Top Industry-Specific Generative AI Use Cases in 2026

Generative AI use cases exemplify the multifaceted applications of AI in mimicking human-like content generation. Utilizing vast datasets, algorithms like ChatGPT and DALL·E 2 discern patterns..

Stay In the Know

Get Latest updates and industry insights every month.

1. Stronger, Faster, and More Accurate Data-Driven Decision-Making

1. Stronger, Faster, and More Accurate Data-Driven Decision-Making