Top 10 Applications of AI in Financial Modeling & Forecasting

Deep learning is the foundation of AI algorithms, and neural networks can see intricate patterns in copious amounts of data. This allows for more precise forecasting of financial measures like margins, revenue, and market trends. AI in financial modeling and forecasting continuously evaluates its output to self-correct its computations and improve the accuracy of its projections.

Struggling With Risk Assessment? Our Developed AI Solutions Provide Continuous Monitoring and Predictive Analysis

“Key findings indicate that AI and ML have significantly revolutionized financial forecasting, offering improved precision in market trend analysis and asset price predictions through innovations in deep learning, reinforcement learning, and hybrid models.”- Research Gate

What is Financial Modeling & Forecasting: Detailed Overview

Businesses can create goals, budgets, and expectations by using financial forecasting to estimate future performance. However, the accuracy of these projections depends on how accurate the forecasts are.

- Businesses can change the future when they use AI in financial modeling and forecasting instead of merely planning for it.

- Financial forecasting is given a new lease on life by artificial intelligence, which processes enormous volumes of data to reveal novel patterns and profound insights.

- The creation of an income statement, balance sheet, and cash flow statement are the three fundamental components of financial modeling. Together, these elements offer a comprehensive view of an organization’s financial health.

Financial modeling is widely used by experts in corporate finance, investment banking, and FP&A. Because they help businesses make highly informed strategic decisions and efficiently assess the financial effects of their actions, the creation and interpretation of financial models is regarded as a highly valued ability. Businesses can rethink their forecasting techniques to achieve a powerful fusion of accuracy, speed, and flexibility.

Why Use AI in Financial Modeling & Forecasting?

The main advantage of using AI in financial modeling is that it can automate repetitive processes, giving teams more time to concentrate on higher-value work. When we consider why people are using AI-based solutions, we find that they are attempting to automate processes to free up time for more strategically minded, high-value work. Probably 90% of our work is spent slogging through the data, with the remaining 10% dedicated to in-depth analysis and the development of fresh ideas and plans. Achieving a 70/30 or even 80/20 ratio would have a significant impact on the caliber of decisions made by businesses, enhancing their capacity to adjust to new information and make wiser choices.

Today, finance teams can leverage AI-powered FP&A solutions to:

- Build dynamic, real-time financial models.

- Provide real-time, auto-updating dashboards for financial metrics.

- Continuously track and assess risk factors.

- Accurately predict future sales and spot trends.

AI in Financial Models and Forecasts Benefits

Thinking of AI as “automation” is helpful when it comes to FP&A modeling and forecasting. To be sure, automation can be extremely complex and involve many processes, but that is essentially the main advantage of utilizing AI in financial modeling and forecasting. To be more precise, the following are some of the main benefits of employing automation or AI technology:

- Improved Forecasting Accuracy: Large volumes of historical and current data can be analyzed by AI models, which may lead to the production of more accurate financial projections.

- Enhanced Risk Assessment: Artificial intelligence offers a more comprehensive knowledge of possible financial risks by analyzing complicated risk factors and how they interact. Proactive risk management is made possible by machine learning algorithms, which can identify tiny signs of a market or financial crisis.

- Pattern Recognition: In financial data, machine learning algorithms can spot small patterns and trends that human analysts could easily miss.

- Stress Testing: Artificial intelligence can create and evaluate a huge variety of stress scenarios, which can help businesses better prepare for unforeseen financial shocks.

Difficulty Spotting Trends? Let Our AI Development Services Uncover Key Patterns and Improve Decision-Making

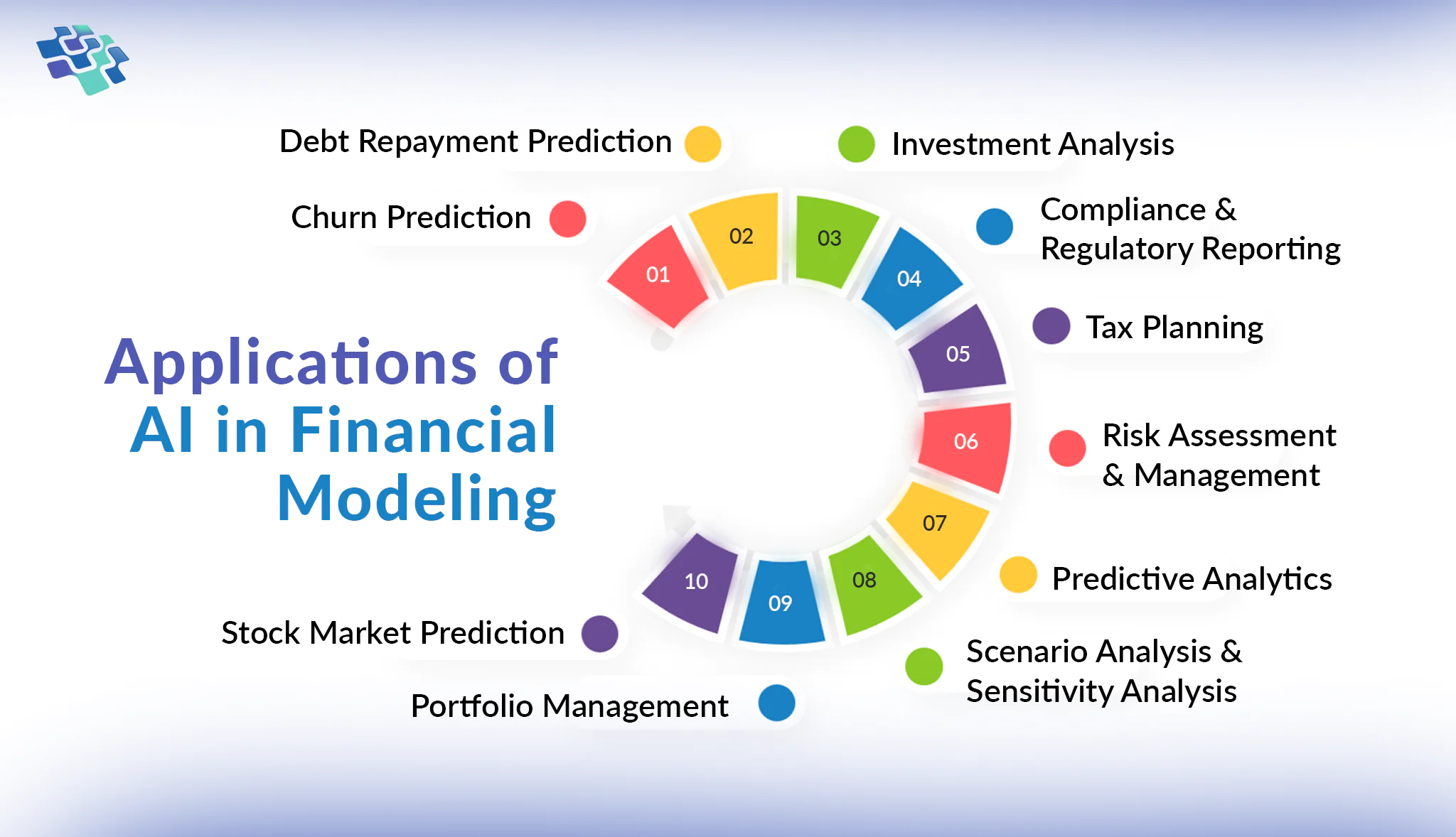

Applications of AI in Financial Modeling

To forecast financial results, identify trends, and support data-driven decision-making, AI in financial modeling and forecasting combines a variety of data sources and computational techniques.

1. Churn Prediction

1. Churn Prediction

AI can use machine learning algorithms to generate predictive models that pinpoint the elements—such as customer demographics, account activity, and customer care interactions—that are most likely to cause a client to leave. Artificial intelligence can also assist in identifying potential churn clients by analyzing vast volumes of data, such as transaction history. Furthermore, data entry and report production are two commonplace processes associated with financial analysis that artificial intelligence can automate.

AI can assist financial organizations in providing tailored products and services that cater to the tastes of consumer segments by using the data that has been analyzed. Additionally, it can alert account managers to a customer’s potential for churn so they can take proactive measures to keep them as clients before they depart.

2. Debt Repayment Prediction

By analyzing data, such as the debtor’s income and expenses, any credit score they can have received, or payment history, AI can assist debt collection companies in predicting debt repayment. The AI-powered algorithms can assist in predicting how much of a particular debt or a debt portfolio will be repaid based on these data. Financial organizations can utilize AI to generate decision trees for debt collection, which can assist them in identifying the best debt collection tactics. Machine learning algorithms fuel the decision trees by analyzing different types of data to produce the best possible decision-making process.

By using the decision trees, debt collectors can choose the optimum strategy for a particular debtor based on their financial status and the length of the debt, increasing the likelihood that missed payments will be successfully collected.

3. Investment Analysis

AI greatly improves investment analysis by analyzing and assessing massive datasets to forecast possible returns and dangers related to different investment possibilities. A variety of data sources, including stock, bond, real estate, and startup information, are analyzed using machine learning techniques including classifiers and clustering algorithms. For instance, whereas clustering algorithms can be used to group comparable real estate properties to anticipate developing market trends, machine learning classifiers can evaluate previous stock performance to identify patterns suggestive of future returns. Through the identification of intriguing prospects and the provision of more precise projections, AI-driven analysis helps investors make timely and well-informed investment decisions.

Furthermore, AI combines with current investment analysis tools to provide improved insights and capabilities. AI in investment analysis can result in more accurate decision-making, better portfolio management, and a deeper comprehension of market dynamics. To ensure trustworthy results, it is crucial to address issues like poor data quality and the requirement for frequent model upgrades.

4. Compliance & Regulatory Reporting

Compliance with intricate financial rules and reporting requirements is greatly aided by AI-driven automation. Artificial Intelligence mitigates the risk of infractions and penalties by automating compliance tasks and regularly updating models with the most recent regulatory updates. For example, AI systems can automatically produce reports that meet new regulatory requirements, ensuring timely and accurate reporting. By incorporating these changes into compliance models and procedures, AI also assists financial firms in staying current with changing rules.

AI also offers thorough audit trails, which raises the standard of accountability and transparency in financial reporting. All things considered, AI-driven solutions provide more efficient compliance management and aid financial institutions in navigating challenging regulatory environments.

5. Tax Planning

Businesses examine the tax ramifications of different company actions using AI-driven financial modeling, which enables effective and strategic tax planning. Businesses can optimize their tax strategies by using AI’s complex or advance predictive skills, which offer accurate projections of tax liabilities under various situations.

AI maintains compliance by finding possible tax savings opportunities and automatically updating models with the most recent tax laws. This assists businesses in making well-informed decisions that minimize tax liabilities while abiding by the regulations.

6. Risk Assessment & Management

Real-time risk assessment and management are significantly enhanced by AI’s ability to swiftly identify and evaluate a variety of financial hazards, including credit, market, and operational risks. By using complex techniques like anomaly detection and predictive modeling, AI models are able to adapt to new data and continuously monitor risk indicators. For example, anomaly detection can identify unusual patterns in transaction data that may point to fraud, while predictive modeling can forecast economic downturns based on historical trends and current signs. This dynamic technique effectively reduces potential losses by promoting timely decision-making and proactive risk management.

By providing actionable insights and facilitating compliance with evolving regulations, artificial intelligence in financial modeling and forecasting helps financial organizations navigate complex risk landscapes. Resilience and financial stability are enhanced as a result.

7. Predictive Analytics

Since AI can anticipate a wide range of financial metrics and economic indicators with great accuracy, its predictive capabilities are essential to financial modeling tools. With techniques like time series forecasting and regression analysis, artificial intelligence can generate accurate forecasts. For example, using historical financial data, time series models can forecast future cash flow, expenses, and income.

Regression analysis is used to predict the effects of economic factors that can affect a company’s success, such as inflation and interest rates. These improved predictions facilitate more informed decision-making and facilitate strategic financial planning.

8. Scenario Analysis & Sensitivity Analysis

By automating the testing of numerous situations, artificial intelligence streamlines sensitivity analysis and scenario analysis. Important financial model parameters can be rapidly changed by AI-driven models, allowing them to assess potential outcomes under different conditions. This automation facilitates a more comprehensive examination by making it simpler to evaluate how changes in specific elements affect financial outcomes.

For instance, AI can simulate the financial ramifications of severe economic events, such as a market crash or recession, and provide a comprehensive analysis of the opportunities and risks associated with them.

9. Portfolio Management

Investor decision-making and data handling are aided by AI’s quick processing speed while examining financial data. It forecasts liquidity problems so that decisions about asset liquidity are well-informed. AI creates conservative portfolios and finds low-risk investments to provide steady returns.

AI financial forecasting algorithms produce more stable profiles that appeal to investors by making portfolios more resilient to market volatility.

10. Stock Market Prediction

Traders and investors face challenges due to the volatility and intricacy of the stock market. Profitable trading chances are identified by AI algorithms that swiftly assess technical indicators, such as stochastic oscillators, Bollinger bands, EMA, RSI, and Fibonacci retracement, for accurate forecasts. Integrating AI in financial modeling increases the accuracy rate of stock price prediction to around 80% while working with hedge funds and other asset management companies.

According to recent statistics, AI-powered hedge funds beat conventional investment houses on every parameter, with returns that are over three times higher than the global industry average.

Lacking Forecasting Speed? We Provide Real-Time, Dynamic Financial Models for Faster Insights

What the Future Holds for AI in Financial Modeling & Forecasting

Fintech innovations like explainable AI and blockchain analytics powered by AI have the potential to transform financial forecasts completely. The goal of explainable AI is to develop AI systems that are easy for people to understand and comprehend, which addresses a crucial demand for financial model confidence and transparency. In the meantime, through the safe and effective analysis of massive amounts of transactional data, blockchain analytics powered by AI can raise the accuracy of financial projections.

With increased sophistication, predictive analytics will be able to give CFOs more accurate forecasts and deeper insights. There will be an increase in the use of automated financial planning tools, which will facilitate quicker and more flexible decision-making. Furthermore, financial forecasting capabilities will be further enhanced by the integration of AI with other cutting-edge technologies like edge computing and the Internet of Things.

Financial forecasting is about to undergo a radical upheaval because of quantum computing. Quantum computers leverage the concepts of quantum mechanics to handle large, complicated datasets and run algorithms at previously unheard-of rates. This has the potential to significantly increase the speed and accuracy of financial forecasting.

Automate Financial Modeling with NextGen Invent

AI in financial modeling offers enormous potential for efficiency, accuracy, and strategic decision-making, and it can completely transform corporate finance.

- It can help financial modeling by automating repetitive operations, decreasing human error, and utilizing large data to make more accurate predictions.

- AI is also a powerful tool for risk management, able to spot anomalies and other peculiar trends.

- It can help experts in corporate finance with regulatory compliance, M&A, and FP&A.

- As AI gets more fully integrated into financial processes, financial analysts must take into account ethical considerations, regulatory compliance, model usability, and data quality.

- AI frees up time for financial analysts to concentrate on higher-value tasks and tactics by supplementing human experience rather than replacing it.

- Effective AI integration can yield substantial benefits for financial institutions, particularly in the areas of risk mitigation, decision-making, and financial insights.

NextGen Invent improves AI forecasting by simplifying complex data processes and delivering actionable insights tailored to your company’s needs. As a leading artificial intelligence software development services company, our team enables users to create their algorithms for a range of uses, including data preparation and predictive analytics. Power BI and Excel can be easily integrated so that teams can use tools that are simple to use and don’t require specialized knowledge to make data-driven choices.

Contact us to discover how NextGen Invent can transform your data into a strategic asset to help your business forecast more precisely and strategically.

Frequently Asked Questions About AI in Financial Modeling & Forecasting

Related Blogs

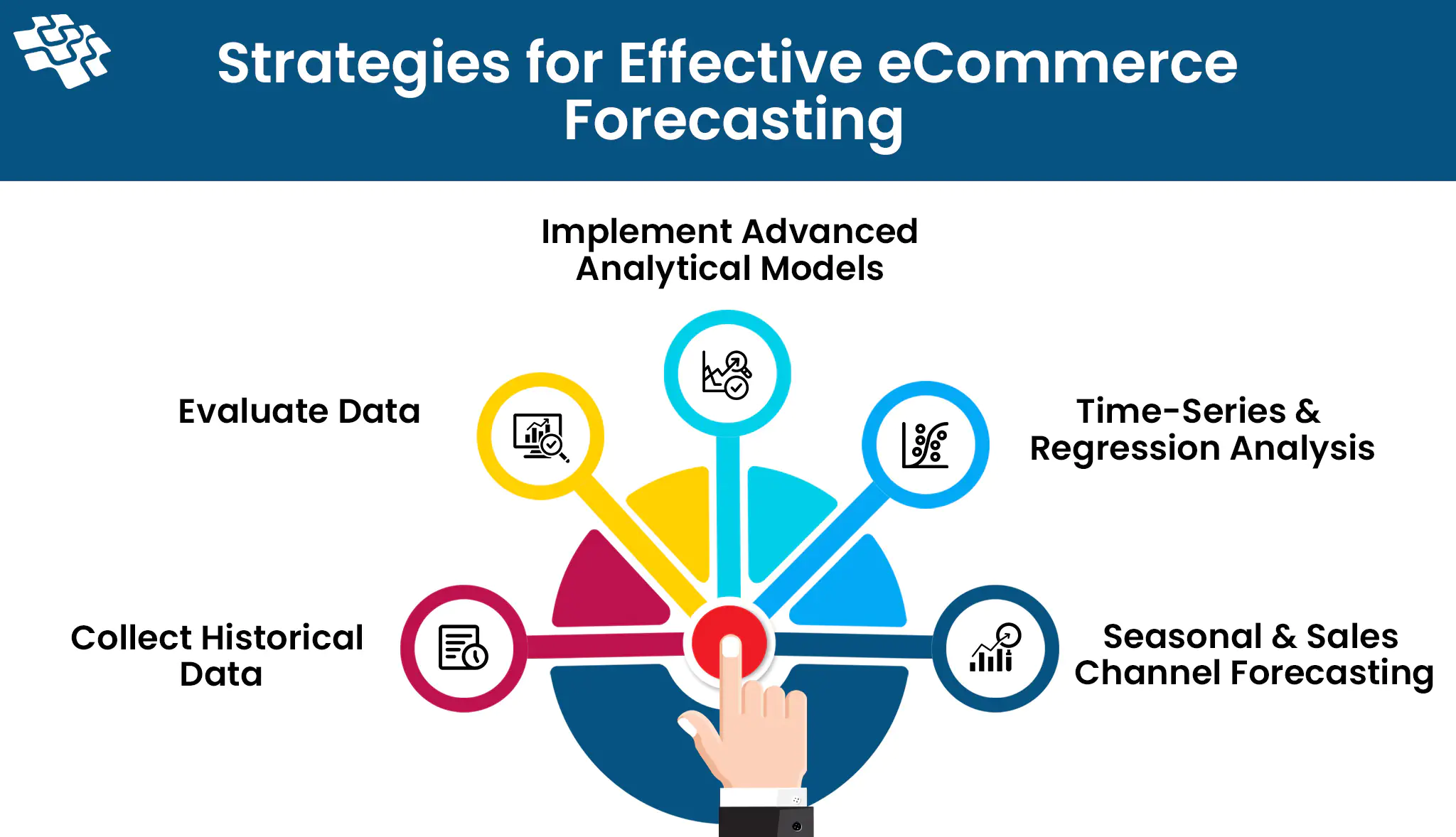

How to Win at Ecommerce Demand Forecasting in 2024?

People aren’t machines. They don’t always behave in the same ways, which can cause problems for an eCommerce business. For instance, a product that did well in sales the previous month may collect dust in a warehouse.

AI in Supply Chain: Embracing Future with Gen AI & Automation

Deepak shared his insights on the latest trends, strategic implications, and the practical applications of these cutting-edge technologies. He also provided a glimpse into the future of supply chain management...

Data Mining for Business Intelligence: How Can It Help?

One of the most essential abilities for business success nowadays is the ability to derive significant insights from large amounts of data through data-driven initiatives. Fundamentally, data mining is more than just a trendy term in IT.

Stay In the Know

Get Latest updates and industry insights every month.

1. Churn Prediction

1. Churn Prediction