How Generative AI in Finance is Solving Cash Flow and Valuation Challenges?

Early attention should start with a solid plan and generative AI finance use cases or proofs of concepts to test and learn using accessible, well-governed data while also keeping risks in mind. Leaders with a clear and consistent grasp of the business case and anticipated ROI, both quantitative and qualitative, should consider the scalability and wider adoption of generative AI throughout the organization.

Losing Value in Inefficient Processes? Let’s Build AI Tools That Streamline Cash Flow and Reporting

“Research has suggested that breakthroughs in generative AI could increase global gross domestic product (GDP) by as much as 7%—nearly $7 trillion—and boost productivity growth by 1.5% points.”- Goldman Sachs

Generative AI in Finance Overview

Generative AI learns from enormous datasets and produces answers to questions. Smarter financial decisions will be aided by the additional data insights generated by its advanced machine learning algorithms.

The financial services sector is adopting generative AI at an accelerating rate. According to a survey by Statista, the financial generative AI market was estimated to be worth $1.085 billion in 2023 and is expected to rise at a CAGR of 28.1% to reach $12.138 billion by 2033.

Staggering Benefits of Adopting Generative AI in Finance

Businesses that have successfully integrated AI into their financial operations have reaped a 33% reduction in the budget cycle time. However, a well-thought-out and deliberate approach is necessary to successfully incorporate generative AI for finance operations. The effectiveness of AI and gen AI projects depends on how well the underlying data supports them. To support their AI strategy, businesses frequently implement a variety of data projects, from data governance to process mining.

To successfully incorporate generative AI in finance operations, you should create the appropriate framework after putting the appropriate data projects in place. Securing the required funds, creating quantifiable metrics to monitor return on investment, and developing a clear business case that clearly outlines the advantages and dangers can all help achieve this.

Next, automate labor-intensive operations by determining which tasks are ready for gen AI automation, beginning with use cases related to risk mitigation and promoting staff acceptance that is in line with actual duties. The objective is to allow Gen AI to take on the repetitive and mundane tasks and to allow the staff to take on critical thinking work.

By putting cost estimating and tracking frameworks into place, simulating financial data and scenarios, and enhancing the precision of financial models, risk management, and strategic decision-making, you should also deploy generative AI to refine FinOps.

Real-Time Financial Forecasting & Strategic Insights

With 78% of banks using a tactical approach and only 8% implementing generative AI systematically, there has been a notable shift in the financial sector’s adoption of Gen AI. By evaluating existing financial data to foresee future performance, generative AI makes it easier to make financial forecasts and projections in real-time. This makes it possible for companies to base their decisions on current data, which is particularly advantageous for financial projections for digital startups.

Additionally, throughout the budget cycle, Gen AI helps business partners by offering insights into financial predictions and scenario planning, resulting in quicker and more thorough business intelligence. To promote quick and unambiguous insight generation, finance tasks that were previously laborious and impeded can be redesigned. These capabilities are further improved by combining Gen AI with conventional AI use cases, which enables recommendations on forecast scenarios and related business decisions and explanations of variations.

From Reactive to Proactive: How Generative AI Empowers Medical Practices to Maximize Valuation Before VC/PE Involvement

- Detect & Prevent Revenue Leakage: AI tools can uncover hidden losses in coding errors, underbilling, and missed reimbursements, issues often exploited by VCs during valuation negotiations.

- Optimize Revenue Cycle Management: Generative AI in finance can identify billing inefficiencies, automate claim submissions, and reduce denials, ensuring stronger cash flow and cleaner financials before investor scrutiny.

- Enhance Financial Forecasting: With AI-powered modeling, practices can project revenue and expenses with greater accuracy, helping owners make data-driven decisions that boost valuation.

- Building a Position of Strength: By improving operational and financial performance ahead of VC/PE interest, practices can negotiate from confidence rather than desperation.

- Create Investor-Ready Insights: Generative AI for finance can generate executive dashboards and automated reports that present a compelling financial story to potential investors or partners.

- Workforce Optimization-Process Improvement: Generative AI enables medical practices to shift from reactive staffing to proactive workforce optimization, predicting demand, automating routine tasks, and reallocating resources efficiently. This streamlines operations, improves care delivery, and enhances valuation before engaging with VC/PE investors.

Disconnected Data Hurting Valuations? We Build Systems That Unify, Analyze, and Act on Financial Data

How Generative AI in Finance is Disrupting Legacy Systems to Solve Fraud, Compliance, and Efficiency Challenges

Generative AI is revolutionizing financial institutions’ operations and customer service, from risk assessment and fraud detection to tailored client experiences. A few noteworthy use cases of generative AI in banking and other financial services are listed below:

1. Risk Assessment & Credit Scoring

1. Risk Assessment & Credit Scoring

The financial industry may revolutionize risk assessment and credit scoring using generative AI technologies, which offer incredibly precise and nuanced assessments of creditworthiness. It can examine more information than just conventional financial measurements, such as social media activity, purchasing trends, and even the wording of loan applications.

Generative AI systems can produce more accurate risk profiles by spotting intricate correlations between various aspects that human analysts might miss. Financial organizations may be able to increase credit availability while upholding strong risk management procedures by using this technology to provide more customized products and interest rates. Furthermore, dynamic credit scores that more accurately represent current conditions can be obtained by using generative AI systems, which can update evaluations continually based on real-time data.

2. Loan Underwriting & Mortgage Approval

Traditionally, a laborious and intricate process, evaluating loan applications is made easier and better by generative AI for financial services. For prospective borrowers, generative AI can generate thorough risk assessments in a brief time by evaluating many data points, such as financial history, job records, market movements, and property appraisals. It can forecast future patterns in property values, which enables better lending decisions.

By tailoring loan conditions according to each applicant’s particular financial circumstances, generative AI in finance can maximize variables like interest rates, loan terms, and repayment plans to best meet the needs of the borrower and the lender’s risk tolerance.

3. Regulatory Code Change Consultant

In the financial services sector, it is crucial to adhere to international rules and adjust to rapid code changes. By taking on the responsibilities of a regulatory code modification consultant, generative AI reduces the workload for developers and ensures a quick response to new specifications.

Generative AI gives developers useful context regarding underlying business or regulatory developments by offering condensed responses together with links to certain locations that hold pertinent information. This makes it easier to comprehend the framework changes required for code changes more quickly, particularly in situations like Basel III international banking standards that need a lot of documentation. Additionally, it helps automate coding changes while maintaining accuracy through human oversight and code repository cross-checking.

4. Customer Sentiment Analysis

Generative AI is essential to customer sentiment analysis in the financial industry since it analyzes news stories, social media, and internet material to determine how the public feels about specific financial services, products, or market movements. When it comes to improving marketing strategies and making well-informed investment decisions, this analytical skill offers invaluable information.

Financial firms can predict changes in the market, quickly adjust to shifting public opinions, and modify their strategies to better suit the sentiments of their clients by measuring the general mood. This proactive application of generative AI in finance ensures a more customer-focused and responsive approach, which eventually helps with better strategic planning and decision-making in the ever-changing banking landscape.

5. Document Analysis & Forecasting

To facilitate more effective analysis and decision-making, generative AI can be used to filter, summarize, and extract meaningful information from massive amounts of financial documents, including annual reports, financial statements, and earnings calls.

Generative AI models may generate predictions about future trends, asset prices, and economic indicators by learning from historical financial data and identifying intricate patterns and relationships.

6. Fraud Detection

By creating synthetic examples of fraudulent transactions or activities, generative AI can be applied to financial fraud detection. These generated examples can be used to train and enhance machine learning algorithms that identify and distinguish between authentic and fraudulent patterns in financial data.

Faster fraud detection and prevention are made possible by these models’ improved ability to recognize suspicious activity due to a better understanding of fraud patterns. Financial organizations can use generative AI in fraud detection systems to:

- Boost the general integrity and security of their operations

- Reduce losses brought on by fraud

- Sustain client trust

7. Performance Management

Generative AI algorithms can produce insights and suggestions for performance optimization by examining the performance data of financial products or portfolios. Financial professionals can find this useful in tracking and enhancing the performance of their investments.

Gen AI focuses on making repetitive tasks instantaneous, such as data analysis and exploration. Finance teams can focus on growing the business instead of spending time on data exploration, driver-based analysis, chart creation, and report commentary.

8. Use of Chatbots for Customer Support

Generative AI-powered chatbots are transforming customer support in banking by offering fast, friendly, and reliable help around the clock. Whether it’s checking balances, guiding users through transactions, or answering common questions, these chatbots make everyday banking easier and more accessible.

They’re trained to understand customer needs while staying compliant with regulations. Best of all, they free up human agents to focus on more complex issues, ensuring that when a personal touch is needed, customers get the attention they deserve.

Automate Financial Forecasting With AI-Driven Tools That Eliminate Manual Errors and Speed Up Decisions

Challenges & Considerations of Generative AI in Finance

- Bias in AI Models: Discriminatory lending practices or credit scoring are just two negative effects of algorithmic bias in generative AI. For instance, Gen AI can determine that a whole demographic group is not eligible for a service or is a non-performing asset (NPA) if it is trained on biased or skewed data. To achieve fair outcomes, organizations need to implement bias-monitoring methods, use different datasets in training, and perform routine audits. To build confidence, transparency in both model development and deployment is equally important.

- Compliance with Regulations: With the Sarbanes-Oxley Act regulating financial transparency and Basel III directing risk management, the financial industry is heavily regulated. It can be difficult to maintain AI models in line with these criteria because regulators are always unable to keep up with the rapid advancement of technology. The necessity for proactive AI governance that strikes a balance between innovation and legal framework compliance is demonstrated by the fact that, in the first half of 2024, global regulatory fines for non-compliance in financial institutions exceeded $2.6 billion.

- Integration with Legacy Systems: Most financial organizations rely on antiquated legacy systems that are incompatible with contemporary artificial intelligence. It takes careful preparation and a large financial commitment to upgrade these systems. Businesses that have embraced hybrid solutions, which connect new AI platforms with legacy systems, are seeing success in this field.

- Data Privacy & Security: Strong encryption and safe storage solutions are crucial for processing vast volumes of sensitive financial data with generative AI. Financial institutions are being forced to keep up with changing threats due to the global increase in cybercrime cases. The CCPA and GDPR mandate the implementation of the most stringent procedures to safeguard consumer data. Serious penalties may be imposed for noncompliance. In the financial services industry, the average cost of a data breach was $5.9 million in 2023, indicating a growing need to implement strict security measures.

The Future of AI in Financial Services

Generative AI in financial technology has a bright future ahead of it because of its advantages and rapid development. These are some of the main elements influencing how generative AI will advance in fintech.

- What’s Next for Generative AI in Finance?

As generative AI in finance continues to evolve, we can expect even smarter and more intuitive tools like real-time fraud detection, adaptive risk models, and AI-powered financial advisors that offer personalized guidance in seconds. These innovations won’t just improve efficiency; they’ll change how people experience financial services.

- Looking Beyond Traditional Banking

The impact of generative AI in finance will reach far beyond everyday banking. It’s opening doors to more inclusive financial systems, strengthening cybersecurity, and enabling the creation of innovative financial products that better meet the needs of today’s diverse consumers. Whether you’re a startup or an underserved customer, AI is helping finance work better for everyone.

- Working Together, the Right Way

With this rapid growth comes responsibility. Financial institutions, technology leaders, and regulators must work hand-in-hand to ensure AI is used ethically and transparently. Building trust through fairness, privacy, and clear communication will be essential as we shape the future of finance together.

Transform Your Financial Services with NextGen Invent’s Generative AI Solutions

The financial services world is moving fast, and generative AI is a big reason why. From smarter customer experiences to stronger fraud protection and better compliance, AI is helping organizations work faster, safer, and more efficiently. And this is just the beginning. As technology matures, its impact on how we manage money, risk, and relationships will only grow.

At NextGen Invent, we’re here to help you tap into that potential. Through our generative AI development services in New York, we build customized solutions that fit your goals, whether you’re upgrading a legacy system or starting something brand new. We make AI integration smooth, practical, and aligned with your business vision.

Security is never an afterthought. Every solution we deliver is designed to protect your data and your reputation, guarding against fraud, cyber threats, and data loss at every step. If you’re thinking about how AI could fit into your financial operations, let’s talk. Our team can walk you through what is possible and what is next.

Schedule a meeting with our experts today and discover how NextGen Invent’s generative AI development services can help you stay competitive, secure, and future-ready.

Frequently Asked Questions About Generative AI in Finance

Related Blogs

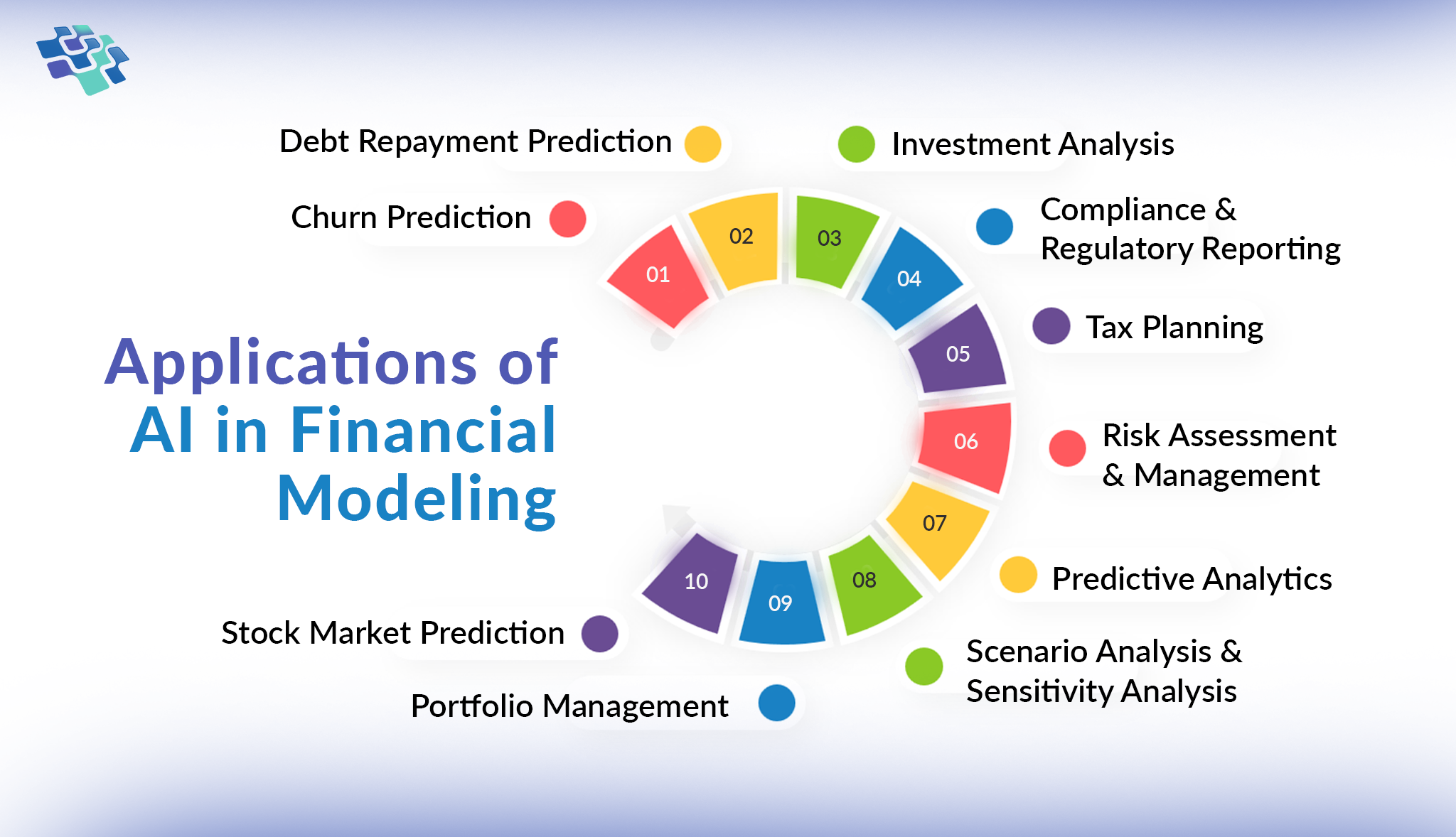

Top 10 Applications of AI in Financial Modeling & Forecasting

AI in financial modeling and forecasting processes data from many sources, uncovering hidden patterns and producing predictions that surpass human capacity. Research shows that 20% or fewer errors were made overall in 50% of organizations that used AI for forecasting.

Top Industry-Specific Generative AI Use Cases in 2024

Businesses leverage Generative AI’s versatility to innovate operations and enhance customer engagement. This technology’s transformative potential is evident in its capacity to streamline processes and create tailored solutions.

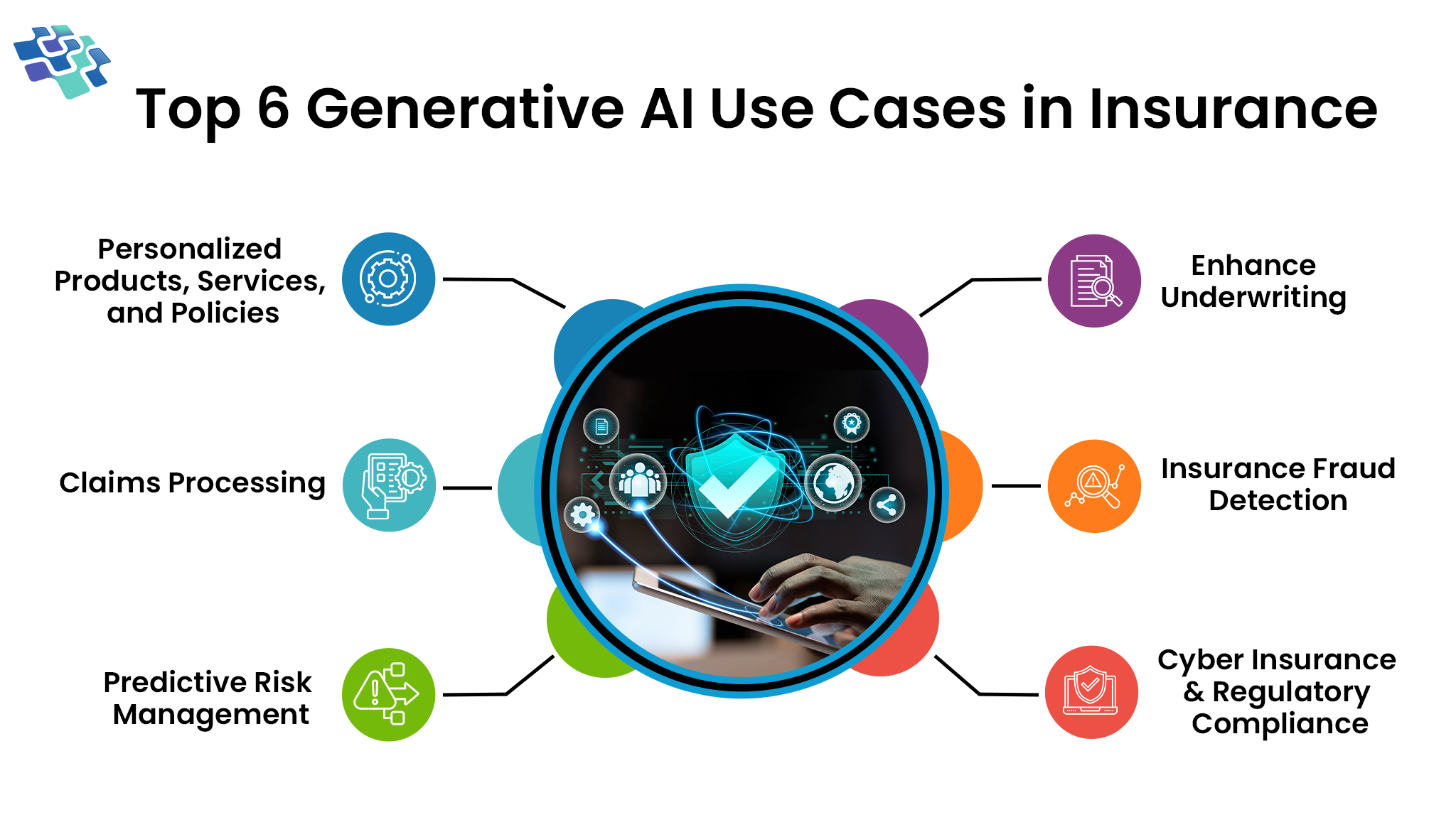

Generative AI in Insurance: How Insurers Can Leverage its Power?

Generative AI in insurance is being used to create documents, enhance claims processing, and customize client interactions. It is the face of artificial intelligence that top insurers are taking notice of.

Stay In the Know

Get Latest updates and industry insights every month.

1. Risk Assessment & Credit Scoring

1. Risk Assessment & Credit Scoring