Generative AI in Due Diligence: Why Traditional Processes Fail & How to Fix Them

With Generative AI embedded in due diligence workflows, unstructured documents are analyzed semantically in days rather than weeks. This evolution is being driven by a growing disconnect between rising deal complexity and traditional due diligence methods. Organizations that fail to modernize risk turning due diligence into a competitive liability.

Accelerate M&A Deal Timelines by Replacing Spreadsheet-Based Reviews with AI Automation

“The outside-in diligence process used to require weeks of manual effort from a diligence team, sourcing public data, mining the seller’s data room, scraping external signals, triangulating expert input, and stitching together all those insights. Now, Gen AI is changing the equation. Gen AI due diligence software can take the first pass, synthesizing vast amounts of public and proprietary data, identifying trends and outliers, and even proposing hypotheses that analysts might not have considered.”- McKinsey

Why Generative AI Is Becoming Essential to Modern Due Diligence

Before signing contracts or making investment decisions, due diligence is a critical investigation and evaluation procedure that is employed to evaluate a business or individual. It ensures that all financial, legal, and operational details are exhaustively examined and comprehended.

Due diligence is indispensable in numerous business operations, including investment analysis, mergers and acquisitions, and partner evaluations. Traditionally, the process entails the meticulous evaluation of extensive amounts of data, which can be both time-consuming and susceptible to human error.

- Proactive Risk Assessment: Generative AI algorithms analyze operational and compliance data to identify trends and anomalies, providing insights into potential threats that human analysts may overlook.

- Improving Document & Contract Review: Generative AI can swiftly scan through complicated documents, contracts, and legal papers using NLP approaches, extracting essential information that is essential for comprehensive due diligence.

- Automation of High-Volume Routine Data Analysis: Generative AI due diligence simplifies the analysis of extensive datasets, thereby decreasing the time necessary to collect and analyze data and enable due diligence teams to concentrate on more strategic duties.

Adopting Generative AI in due diligence is not only advantageous but also increasingly necessary for businesses to successfully manage risks and stay competitive.

Check Our Case Study: Technical Accelerator Diligence: Future-Proofing a Digital Health Platform

AI Vendor Due Diligence: Managing Risk and Trust in Strategic Partnerships

A successful integration of AI into your company’s due diligence procedures depends on your choice of AI vendor. Businesses run the risk of exposing data, breaching regulations, or integrating technology inadequately if they don’t evaluate. Among the crucial areas for vendor assessment are:

- Security Measures: Examine the vendor’s cybersecurity infrastructure, taking note of threat detection systems, access controls, and encryption processes. Make sure they have procedures in place for handling incidents and conducting routine security audits.

- Data Handling Practices: Analyze the vendor’s ownership, confidentiality, and data security policies. To prevent sensitive information from being misused or lost, look for clear data processing, storage, and retention policies.

- Technological Expertise: Consider algorithm performance, flexibility, and compatibility with your company’s goals when assessing the vendor’s AI capabilities. Verify the dependability, scalability, and development of roadmap support for their solutions.

How Generative AI in Due Diligence Is Redefining Workflows

There is a clear pattern to the operational integration of Generative AI in due diligence: intelligent extraction, risk synthesis, and automated ingestion and classification.

- Intelligent Extraction: AI systems comprehend contractual semantics rather than keyword searches. They detect risks (renewal terms, termination clauses, liability caps, indemnity provisions), extract requirements (payment terms, service levels, performance indicators), and flag anomalies (contracts that differ from conventional terms or expose the organization to exceptional risk).

- Synthesis & Prioritization: AI-powered risk identification links results from different documents. It finds cross-contract risks, accumulated debts that could strain cash flow when added up, and trends that point to operational or compliance problems that need more research.

- Automated Intake: After entering an AI system, documents are categorized according to their nature (e.g., financial statements, contracts, correspondence, and regulatory filings), mapped to deal entities, and indexed for semantic search. Instead of weeks, this takes place in hours.

Generative AI in Due Diligence: Benefits That Matter

- Increased Data Accuracy: The errors and inconsistencies commonly seen in human procedures are removed by AI-powered extraction and analysis, which yields trustworthy data for well-informed decision-making.

- Improved Compliance & Risk Management: Generative AI can assist ARCs in spotting red flags early in the due diligence process, lowering the chance of acquiring problematic assets by highlighting discrepancies, hazards, or compliance issues in documentation.

- Cost Efficiency & Scalability: In addition to lowering operating expenses, eliminating the need for manual document review frees up analysts to work on higher-value projects like creating restructuring plans.

- Enhanced Decision-Making: Generative AI’s real-time insights enable ARCs to rapidly analyze risks, appraise asset quality, and decide whether purchasing distressed assets is feasible.

Challenges & Limitations of Generative AI in Due Diligence

Generative AI due diligence has certain restrictions and drawbacks despite its many advantages.

1. AI Bias & Data Interpretability

One significant challenge in dealmaking is the possibility of AI bias. In the absence of compelling reasons for their decision-making procedures, AI systems may exhibit biases found in training data, which could distort the results of due diligence. As “black boxes,” many AI algorithms make it challenging for stakeholders to comprehend the reasoning behind the results drawn from crucial business assessments.

2. Data Limitations & Resource Requirements

Limitations in data also present practical challenges. It can be complicated for AI to conduct thorough evaluations of non-public organizations since their information is frequently inconsistent, lacking, or non-standardized. Effective Generative AI in due diligence implementation necessitates a large investment in technological infrastructure, trained personnel, and continuous system upkeep.

3. Integration with Established Due Diligence Workflows

Integration becomes challenging when AI is introduced into existing due diligence workflows. Organizations frequently find it difficult to:

- Define clear handoffs between AI outputs and human review

- Strike a balance between automation and human discretion.

- Upskill teams on new AI platforms

4. Data Privacy & Limitations

When handling sensitive company data, generative AI in due diligence systems raises serious data privacy issues. Strong security measures must be put in place by businesses to protect against data breaches when sensitive documents are analyzed digitally. Limitations in data also present practical challenges. It can be challenging for AI to conduct thorough evaluations of non-public organizations since their information is frequently inconsistent, lacking, or non-standardized.

Streamline Third-Party Vendor Risk Reviews with AI Due Diligence Automation

Real-World Applications of Generative AI in Due Diligence

Throughout the whole transaction lifecycle, Gen AI is being used in financial advising work. It has many noteworthy features that provide instant benefits. Organizations can find possibilities and hazards more quickly by using AI in investment analysis.

1. Document Ingestion and Semantic Q&A

1. Document Ingestion and Semantic Q&A

Many PDFs, CSV files, and financial reports are processed by today’s Gen AI systems, which enable instantaneous searchability. Simple queries like “What drove revenue growth in Q3?” or “Show me all environmental liabilities in the VDR?” Can be asked by analysts, and they will receive responses that include direct links to the original documents. Semantic chunking preserves context by dividing documents into relevant chunks behind the scenes. Even when terminology differs, hybrid retrieval uses a combination of keyword and semantic search to locate pertinent information.

This method can capture more important facts while drastically cutting down on document review time. Hidden investment opportunities are revealed by Gen AI through the assessment of large datasets, including alternative data driven by AI.

2. Vendor Classification & Auto-Generated Reporting

Gen AI in due diligence is exceptionally good at classifying thousands of vendor records under exposure tiers, criticality groups, and categories for restructuring initiatives. This facilitates identification of redundancies for consolidation, risk mapping throughout the supply chain, and intelligent payment priority during cash constraints. Now, Gen AI creates reports for analysts to edit and automate the process of responding to important diligence questions based on a thorough VDR analysis.

Structured studies of past financial performance, dangers of customer concentration, competitive positioning, problems with regulatory compliance, and integration opportunities are generated by the system. By giving analysts a head start, these draft reports speed up reporting. When appropriate oversight is required, an evaluation system automatically highlights edge cases for human specialists.

3. Pattern Recognition & Risk Assessment

AI goes beyond basic document processing by integrating seamlessly with systems, databases, and policies to:

- Identify risk and opportunity patterns in financial data

- Cross-compare large document sets to uncover inconsistencies

- Flag potential regulatory and compliance issues

- Analyze historical data to anticipate future risks

4. Regulatory Monitoring

To make sure due diligence complies with legal requirements, generative AI in due diligence keeps track of changes to laws and regulations in several jurisdictions. It ensures prompt response to any effects by providing due diligence teams with real-time alerts about pertinent regulatory changes.

Gen AI due diligence keeps due diligence records up to date and thorough by automatically updating and maintaining compliance documentation in response to new rules.

5. Contract Review

Generative AI in due diligence identifies and extracts critical contract clauses for faster and more accurate assessment. It summarizes lengthy contracts into concise reports, saving time and highlighting key points for review.

It cross-references terms and clauses against current regulations to ensure all contracts comply with existing laws. It analyzes contracts to identify potential risks and recommends actions to mitigate them, protecting interests.

6. M&A Synergy Identification & Resource Allocation

Generative AI enhances mergers and acquisitions by uncovering potential synergies across financial, operational, and strategic data, enabling more informed deal evaluations. It supports decision-makers by generating structured insights, scenario analyses, and investment-ready reports at speed and scale. Beyond analysis, Generative AI also optimizes resource allocation during due diligence by assessing workload, project complexity, and timelines. This ensures teams deploy the right expertise at the right stage, reducing inefficiencies and bottlenecks.

By aligning analytical depth with operational efficiency, Generative AI helps organizations conduct faster, more focused due diligence while improving deal confidence, execution quality, and overall transaction outcomes.

Eliminate Manual Document Review Bottlenecks With AI-Powered Intelligent Data Extraction

Applications of Generative AI in Due Diligence Across Industries

With its improved efficiency, accuracy, and decision-making powers, Gen AI in due diligence is revolutionizing how various industries handle assessment and analysis in possible commercial deals. The following lists the ways AI is being used in due diligence in several industries:

Finance & Banking

- Due Diligence for Asset Management: Compared to conventional techniques, AI algorithms can evaluate financial data, market trends, and company-specific information more quickly and precisely. This makes it possible for asset management firms to evaluate risks, obtain a greater understanding of investment opportunities, and make better investment choices.

- Credit Risk Assessment: By analyzing financial data, payment history, and market trends, artificial intelligence evaluates credit risk and forecasts the probability of default or late payments, which helps determine a company’s trustworthiness.

Check Our Client Testimony: Smooth Sailing: NextGen Invent’s Role in Due Diligence Process

Manufacturing & Supply Chain

- Risk Assessment: AI can identify potential risks like legal battles, financial instability, or reputational concerns by analyzing a company’s internal and external data to provide insightful information about its operations, financial health, market position, and industry dynamics.

- Product Quality & Safety: AI is useful in mergers and acquisitions because it evaluates product quality and safety concerns by analyzing data on product recalls, safety alerts, and quality control requirements.

Insurance

High data quantities, intricate risk assessment models, and strict regulatory compliance are characteristics of the insurance sector. Due diligence in this industry is being transformed by AI:

- Accelerated Risk Assessment: Large datasets may be quickly analyzed by AI algorithms to find hazards like false claims, poor underwriting, and exposure to disastrous occurrences.

- Enhanced Fraud Detection: By identifying patterns of fraudulent activity, AI-powered systems can lower claims payouts and shield insurers from monetary losses.

Further Read: Top Industry-Specific Generative AI Use Cases in 2026

Guiding Principles for Effective AI Technology Due Diligence

It’s critical to adhere to a strong due diligence structure because of the possible consequences of inadequate due diligence in Generative AI. The following are some guidelines:

- Engaging AI Experts: It is crucial to involve professionals in the due diligence process because of the complexity of AI. According to a Harvard Business Review study, businesses that include technical specialists in the due diligence process have a higher chance of making profitable investments.

- Evaluating Data Quality and Algorithm Bias: Two crucial factors to consider are the quality of data used to train AI and the existence of bias in algorithms. According to a survey, among other reasons, problems with data labeling or quality account for 80% of AI project failures. Furthermore, considering the possible ethical and legal ramifications, it is imperative to comprehend how an AI system handles bias.

- Knowing the Right Questions to Ask: Investors might find important insights by knowing the important questions to ask during due diligence. The data used to train and validate AI models, for example, or the way the AI solution manages bias and fairness, can provide crucial information. However, according to a poll, 65% of executives were unable to describe the decision-making process of AI models. This emphasizes the necessity of asking more perceptive questions when conducting due diligence.

Generative AI Due Diligence, Designed for Accuracy, and Impact with NextGen Invent

In today’s high-velocity business landscape, due diligence is no longer about speed alone; it’s about precision, resilience, and strategic intelligence. As an enterprise AI software development company, NextGen Invent applies generative AI to reengineer complex diligence workflows into intelligent, data-driven decision systems that reduce risk and elevate outcomes. Partnering with NextGen Invent gives you access to an ecosystem purpose-built for impact:

- Intelligent AI pipelines: Custom AI and machine learning models that integrate seamlessly into existing workflows to address specific diligence challenges.

- Accelerated time to value: Rapid implementation of tailored AI solutions, delivering actionable insights in weeks rather than months.

- Responsible, compliant AI: Built-in governance, transparency, and regulatory alignment at every stage.

- Cross-domain expertise: A blend of AI, data science, and industry knowledge delivering end-to-end support from strategy to deployment.

With NextGen Invent, Generative AI in due diligence doesn’t just accelerate reviews; it strengthens strategic judgment, enabling teams to focus on insights, risk management, and confident decision-making.

Frequently Asked Questions About Generative AI in Due Diligence

Related Blogs

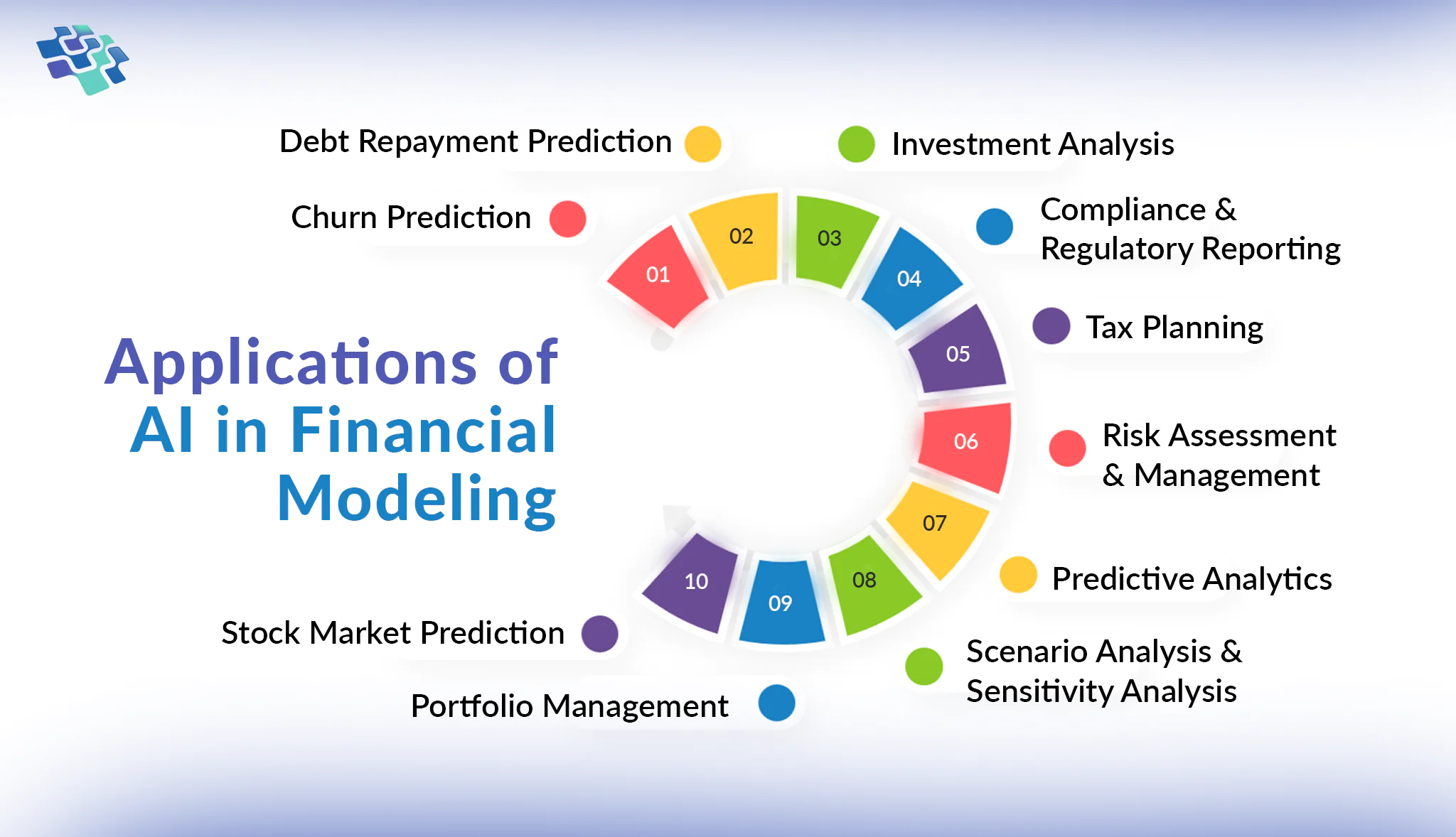

Top 10 Applications of AI in Financial Modeling & Forecasting

AI in financial modeling and forecasting processes data from many sources, uncovering hidden patterns and producing predictions that surpass human capacity.

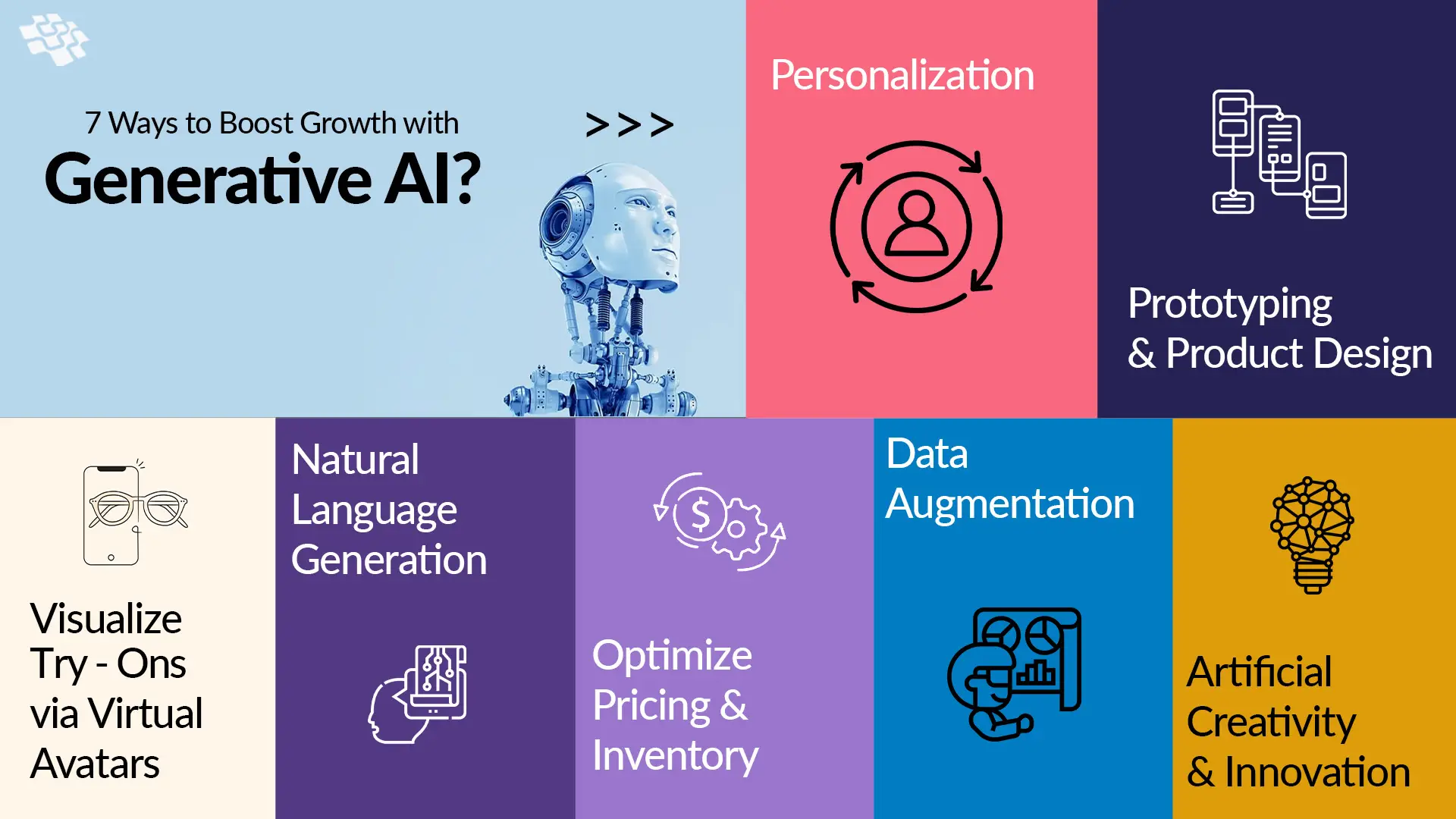

7 Ways to Boost Growth with Gen AI for Business

Generative Artificial Intelligence operates at the forefront of artificial intelligence, leveraging machine learning and neural networks to autonomously generate diverse creative content, spanning literature, images, and music.

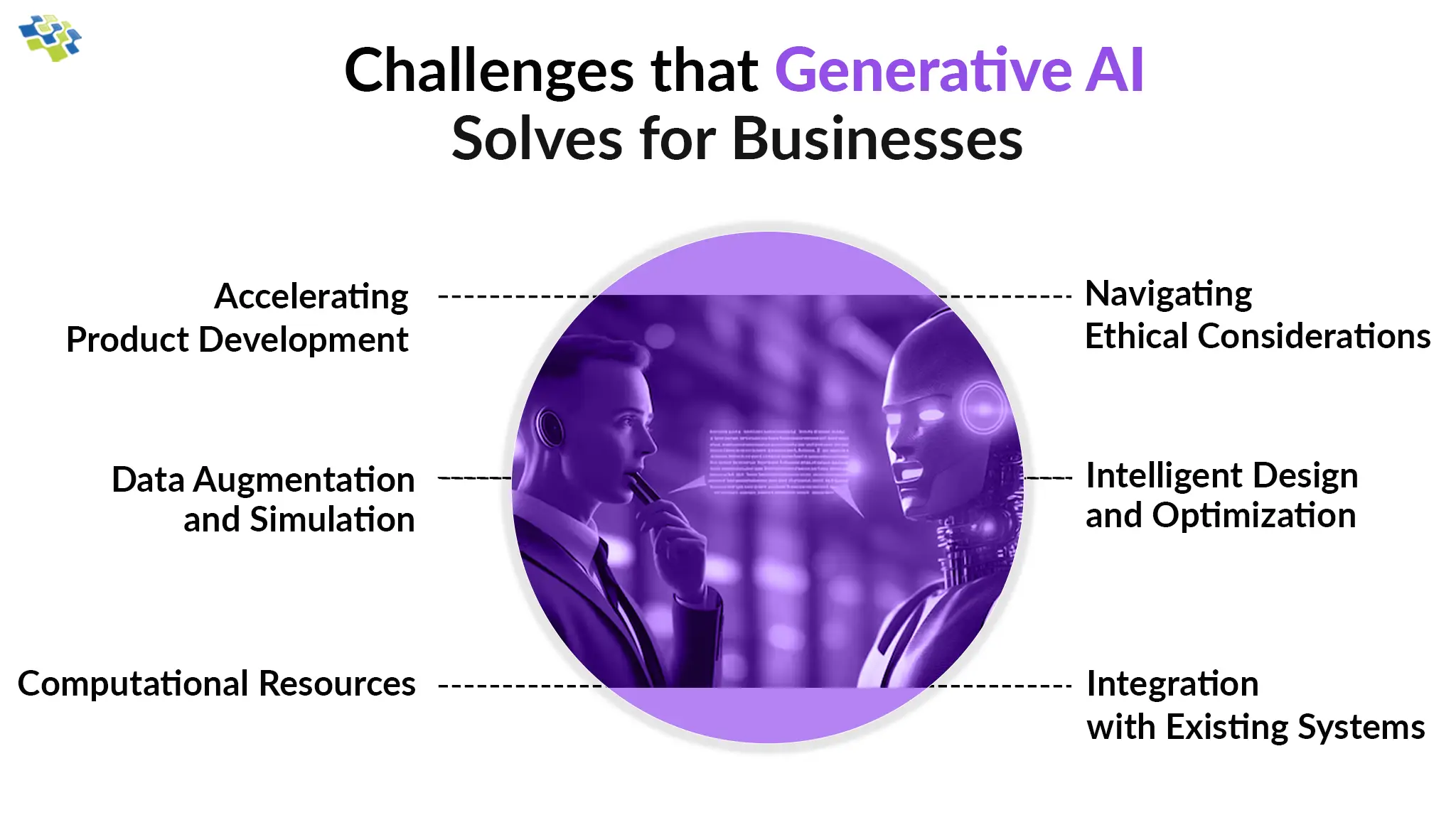

What Challenges Do Generative AI Solutions Solve for Businesses?

Generative AI solutions empower small enterprises and startups to unlock unprecedented possibilities and maximize their endeavors through advanced algorithmic capabilities and comprehensive datasets.

Stay In the Know

Get Latest updates and industry insights every month.

1. Document Ingestion and Semantic Q&A

1. Document Ingestion and Semantic Q&A